Policy experts: California needs to reform its tax system

By Krystina Skurk

California’s reliance on a notoriously fickle tax system has exacerbated the state’s budget problems in light of Covid-19, an economics professor said.

The state of California relies heavily on income tax and capital gains tax for much of its revenue despite the fact that many experts say these are inherently unstable revenue streams. According to a report from the California state government in 2019, 68.8 percent of California’s revenue was made up of personal income tax . . .

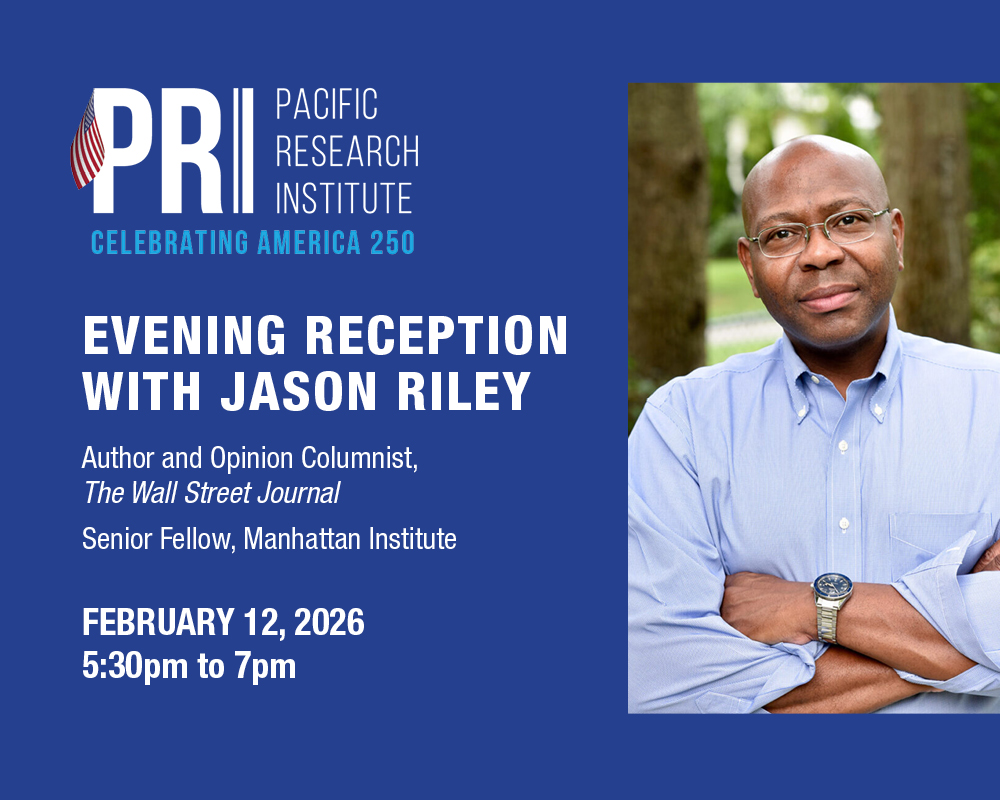

Tim Anaya, senior director of Communications at the Pacific Research Institute in Sacramento, also says that California’s tax system has gotten the state into fiscal trouble.

“Budget experts and economists have argued that even a modest recession in California could cause a big hit to state revenue because of our volatile tax system that is over-reliant on capital gains taxes,” he stated.

Newsom and the legislature have recently come to an agreement that eschews Newsom’s proposed budget cuts to K-12 education in favor of deferrals. This means that schools are free to spend more than is allotted to them in the budget with the promise that the state will pay them back the following year, Edsource reports.

“Democrats are essentially delaying tough budget decisions and setting the state up for more budget pain in the long run,” Anaya said.