The Electric Kool-Aid Subsidy Test

Tax credits for electric cars are a classic income transfer to the rich. Time to end them.

President Trump’s recent blowup over General Motors layoffs was largely misdirected, though it may spur at least one good policy result. Killing subsidies for electric cars and trucks would be a victory for taxpayers, the federal fisc and the car industry . . .

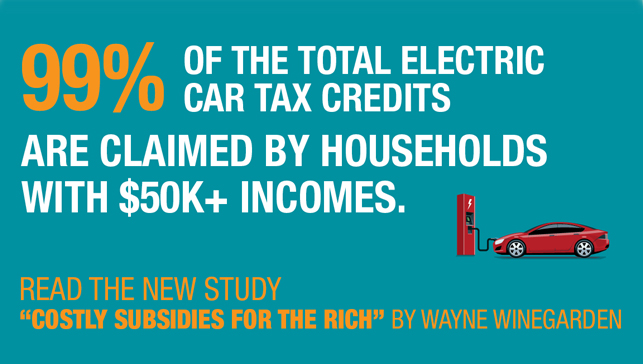

Wayne Winegarden of the Pacific Research Institute looked at 2014 IRS data and found that 79% of federal EV tax credits were claimed by households with adjusted gross income of more than $100,000. Only 1% of EV buyers earned less than $50,000.

Some states and localities also hand out EV breaks, allowing consumers to reap up to $15,000 (California) or $10,500 (Connecticut) per car. This means the federal program is also a geographic wealth transfer, benefiting mainly wealthy coastal havens. The latest sales data from August shows that 53% of EV sales were in California. The subsidy will cost some $2 billion through fiscal 2019. And taxpayers will also have shelled out another $5.5 billion directly to car makers in federal grants and loans for manufacturing and technology programs by 2019, according to the Winegarden data . . .