Now that the calendar page has turned to June, it’s crunch time for lawmakers and the Governor to reach a budget agreement before the June 15 constitutional deadline to pass a balanced budget.

However, a new multi-year analysis of the state budget’s picture released last week suggests that enacting the Governor’s “May Revise” budget plan would set the state on the path to serious budget problems in just a few short years.

The nonpartisan Legislative Analyst’s Office (LAO) argues that the Governor’s plan is “barely balanced,” but the state would have “a positive ending fund balance through (the) 2025-26 (fiscal year).”

As I previously wrote, Capitol budget writers are facing increasing pressure under the terms of the Gann Limit, also known as the State Appropriations Limit, requiring tax revenues over a certain level to be returned to taxpayers or spent in a few allowed areas.

According to the LAO, lawmakers would have to account for $10 to $20 billion in require spending or tax rebates over this period as required by the Gann Limit, and “the administration does not include a plan to address these requirements, which would far exceed the state’s operating capacity.”

In other words, warns the LAO, “the state would likely have significant budget shortfalls” soon if the May Revise is enacted.

The LAO also encourages budget writers to adopts its more conservative revenue estimates to mitigate a likely recession and take a more proactive approach to planning for a potential budget shortfall.

Those warnings will likely be ignored by Gov. Newsom and liberal lawmakers at the State Capitol, who are more interested in handing out money than preparing for the future. They are counting on voters to approve a yet-to-be-proposed change to the Gann Limit that would negate its upcoming spending demand and let legislators spend as they wish. But that’s a big lift, as the Gann Limit’s requirements mirror the priorities of Californians – educating, infrastructure, debt payment, tax relief.

The other major outstanding budget item that has not yet been resolved is a plan to address California’s rising gas prices, which have climbed to a record high $6.08 per gallon on average in California as of May 27 according to AAA.

Fox 40 News in Sacramento reports that, “a bipartisan group of Republicans and moderate Democrats are aiming to push a bill through the State Capitol that would suspend the state’s gas tax for a year.”

They sent a letter to Assembly Speaker Anthony Rendon asking that the measure be withdrawn from committee and brought up for an immediate vote before Friday’s deadline to pass legislation out of the house of origin.

“AB 2457 was developed throughout bipartisan discussions to suspend the gas tax for a full year, create a reasonable but meaningful enforcement mechanism to ensure oil companies pass on those tax savings to drivers, and backfill every penny to critical infrastructure projects from the near $100 billion surplus,” the lawmakers wrote.

The plea was ignored as Speaker Rendon rejected the request and lawmakers turned down an effort led by Assembly Republicans to bring the bill up for an immediate vote.

It’s a reminder that even though large numbers of Democrats and Republicans want to suspend the gas tax, nothing will happen unless Newsom and the Legislature’s Democratic leadership agree. As they squabble amongst themselves about what form – if any – relief should take, the gas tax continues to be the thorniest outstanding budget issue as June 15 rapidly approaches.

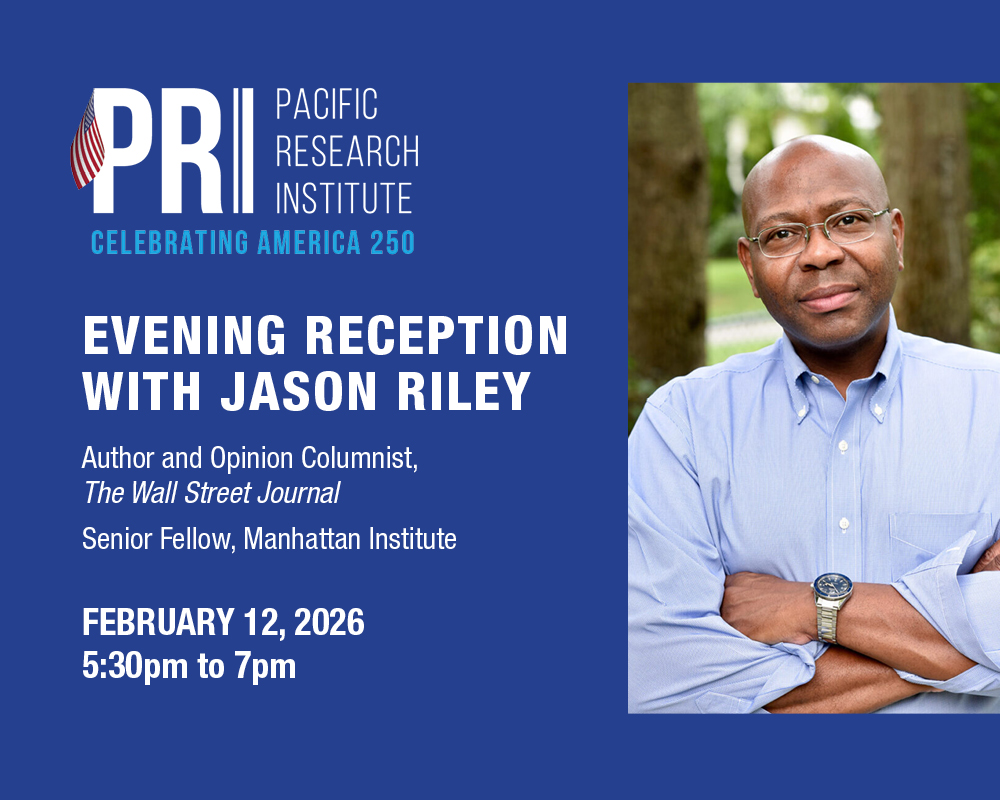

Tim Anaya is the Pacific Research Institute’s senior director of communications and the Sacramento office.