Gov. Gavin Newsom continues to puzzle over a “mystery surcharge” for gasoline. The enigmatic fee was first identified in 2017 by Severin Borenstein, an energy economist at the University of California, Berkeley’s Haas School of Business. It explains, he says, “the extra amount we pay for gas that can’t be explained by higher taxes and producer costs.”

A couple of years later, Newsom asked the California Energy Commission to investigate the “unaccounted-for price differential” that “may stem in part from inappropriate industry practices.” In its just-released 2024 Annual Report, the Division of Petroleum Market Oversight (DMPO) supposedly confirmed the existence of the surcharge, estimating it added an average of 41 cents per gallon of gasoline between 2015 and 2024.

The DMPO also says the “surcharge” cost motorists $59 billion during that period. Of these costs, “higher gross gasoline industry margins in California make up the largest share” – an estimated 35 cents per gallon.

There is one question the report fails to answer: If refiners are earning exceptionally high profits in California, then why are they shutting down their operations in the state? You would think that companies would want to expand their production where they earn excessively high profits. The answer, of course, is that companies are not earning enormous profits in California.

The DMPO report uses the higher-than-average gross margins for refiners to support its claim that unwarranted profits are driving the mystery surcharge. Gross refinery margins are higher in California than the average state, we won’t argue otherwise. But gross margins are not profits, net profits are.

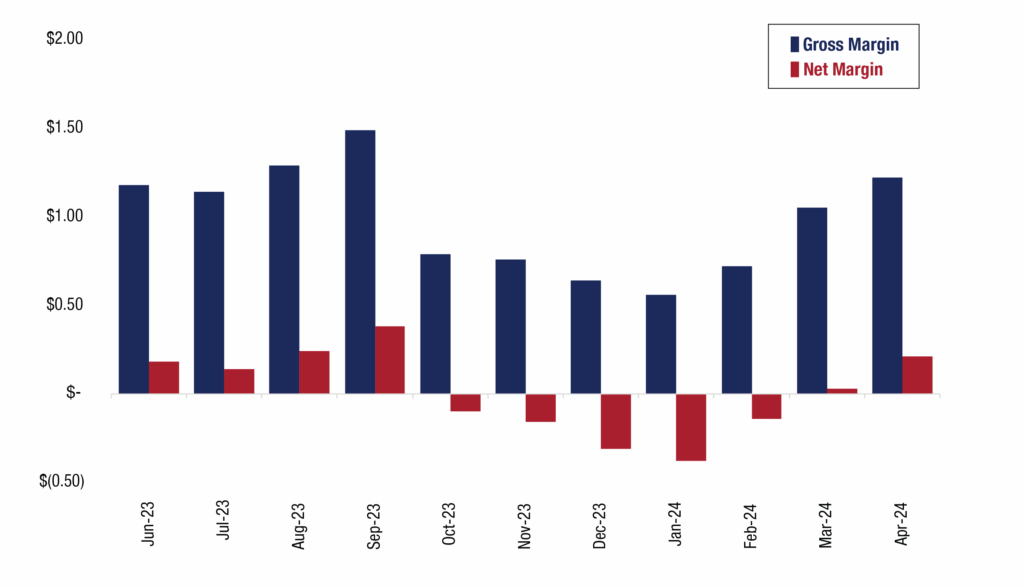

Examining separate data that is maintained by the California Energy Commission’s (CEC) provides important perspective on the net margin question. This CEC maintained data demonstrate that the net margins for California refiners were extraordinarily low between June 2023 and April 2024. In fact, on a weighted volume basis, refiners lost money in five of the 11 months that CEC provides data. In other words, CEC’s own net margin data demonstrates that refining gasoline in California is far from being overly profitable.

The CEC’s data on gross margins is updated through August 2025 but, for some reason, the net margin data is only updated through April 2024. However, the average gross margins between May 2024 and August 2025 were around 68 cents per gallon. Based on the relationship between gross-to-net margins between June 2023 and August 2024 (see the figure), it is likely that the industry net margin was negative during most of this period as well.

Net Margins Demonstrate That Refining Gasoline in California is Often a Money Losing Operation

Advocates such as the Consumer Watchdog attempt to undermine this reality by claiming that “oil refiners are clearly obfuscating and padding their true expenses so that they can falsely claim a reasonable net margin.” The state’s loss of refining capacity demonstrates this is baseless.

In reality, there is no mystery surcharge. Gasoline costs more in California because the state has stranded itself on an “energy island” and imposes a tax-and-regulation regime like no other in the country. It is due to these policy decisions that California’s gasoline prices are the highest in the nation.

California has been operating under an independent set of automobile emissions rules since at least the 1960s, when it established the nation’s first tailpipe standards. This penchant for acting alone has created a regulatory web that has turned California into an energy island.

Californians are forced to buy boutique gasoline blends (the formulations change with the seasons) made and sold nowhere else in the U.S. When supply is low after a refinery has closed because it has become too difficult to do business in the state or shut down due to fire, or is not in line with demand for any other reason, importing gasoline from another state to meet consumer needs is not an option. Supply shortages and rising costs inevitably result.

State and local taxes also contribute to the steep costs at the pump. They include the 61.2-cents per gallon excise tax, the 18.4-cents federal excise tax, environmental regulatory costs (including the low carbon fuel standard and cap-and-trade program) of 54-cents per gallon, the 2-cent underground storage tax fee, and the 3.8 percent average state and local sales tax. Throw in the overhead to cover the labor and energy mandates that further drive up the costs of operating any business in the state, and the “mystery surcharge” is not so mysterious. It is the expected outcome from overly burdensome state tax and regulatory policies.

There has never been a real mystery when it comes to the cost of gasoline in California. The Golden State creates artificial shortages and imposes costly burdens on refining gasoline and then wonders why it is so unaffordable. The answer is as obvious as the solution.

Dr. Wayne Winegarden is a senior fellow in business and economics at the Pacific Research Institute. Kerry Jackson is PRI’s William Clement Fellow in California Reform.