Lacking Fundamental Reforms, California’s Fiscal Outlook Is Still Dismal

Wayne Winegarden and Nikhil Agarwal

December 2025

The Legislative Analysts’ Office’s (LAO) latest Fiscal Outlook for 2026-27 warns that more budget pain is on the way.

The nonpartisan budget analyst’s review concurs with previous PRI Spending Watch analyses where we warned that California’s fiscal crises were likely to persist for many years into the future.

The LAO describes the state’s upcoming budget position as “weak” while noting that the governor and legislators will need to close an $18 billion budget shortfall. Making matters worse, this will be the third year in a row that the governor and legislators have had to address a significant budget problem.

Ultimately, the state is facing recurring budget problems because our political leaders have failed to grasp that the budget is on an unsustainable path. California’s budget has two interrelated problems. The state’s tax system is excessively volatile and excessive state spending has driven tax revenues well beyond the private sector’s ability to afford it, see the figure below.

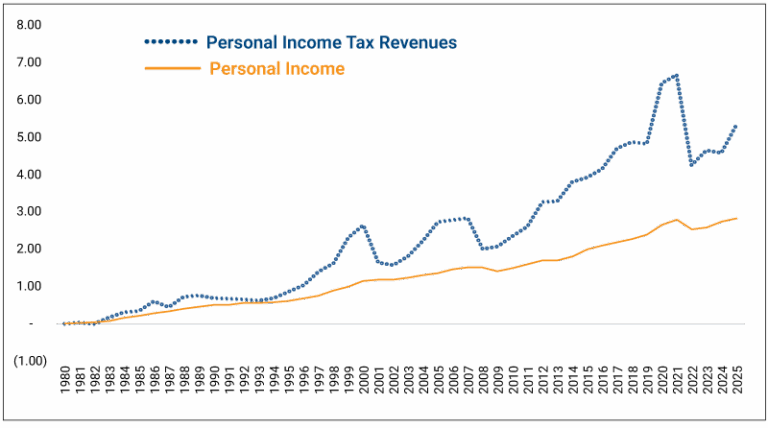

Personal Income Tax Revenue Revenues Outpacing Economic Growth

The figure scales the inflation-adjusted state’s personal income and personal income tax revenues to compare their growth and volatility between 1980 and 2025. The figure demonstrates that personal income tax revenues have grown excessively relative to personal income – over the past 46 years inflation adjusted income tax revenues have more than quintupled while inflation adjusted personal income has merely tripled.

This problem of excessively growing expenditures persists today. Compared to 2019, inflation adjusted General Fund spending is up 28 percent and total tax revenues are up around 16 percent. These are both significantly higher than the 13 percent growth in real personal income.

Not only has personal income tax revenues grown excessively relative to the private sector over the last half century, but there are also unsustainable surges that are associated with financial excesses – the dot.com bubble of the 1990s and the housing bubble that led to the 2007-09 financial crisis. The possibility that there is an artificial intelligence (AI) bubble today creates a huge budget risk for California going into the new year.

The LAO notes that income tax collections have been growing steadily, but while the growth in income tax revenues “have been strong in recent months,” the LAO ties this strength to the artificial intelligence boom that has boosted the stock market and tech worker compensation. Stock market compensation is fickle, however, and there are mounting signs that the market is overheating.

Should the market experience a major correction, then based on California’s history, California’s income tax revenues would decline significantly. As the LAO’s forecast does not assume that there will be a major correction in the stock market, the budget shortfall could be even larger than their current $18 billion estimate.

Adding to the concerns, as the LAO notes, the current growth in corporate income tax revenues and sales tax revenues are “in line with generally weak economic conditions.” A weak economy typically portends rising fiscal stress for the state as revenue growth lessens while pressure on state expenditures increases.

This begs the question: how can the state improve its weak fiscal position? The answer is simple: reduce the state’s excessive spending. Rather than addressing California’s fundamental problem of an unaffordable budget, the politicians in Sacramento have responded to the state’s structural problems with budget gimmicks.

Over the past few budget years, these gimmicks have included short-term fund shifts, temporary borrowing, and one-time spending reductions. However, as we previously warned, short-term thinking does not solve a long-term problem. The state’s reserves have now fallen to $14 billion, which are down about 50 percent from their peak. These reserves are inadequate relative to the future budget shortfalls that the state will face, which could be as high as $30 billion or more. Remember that lawmakers are also restricted in how much they can take out of the reserve in one budget year.

These trends once again foretell that California’s budget picture will remain bleak for the foreseeable future. If past is prologue, then expect Governor Newsom to feign fiscal responsibility during the FY2026-27 budget cycle but, ultimately, propose a budget that fails to meet the moment. On the bright side, at least it will be his final budget. Here’s hoping the next governor will take his or her fiscal responsibilities more seriously.