AB 4: A Bad Idea That Costs Too Much

Wayne Winegarden and Nikhil Agarwal

May 2025

As we noted in an earlier Spending Watch piece, growing economic volatility will likely cause revenue growth to be much weaker than expected for the upcoming FY2025-26 budget. It is, consequently, fiscally irresponsible for the Governor and Legislature to be considering any new government programs – the focus should be on imposing strict spending control.

Given this context, Assembly Bill 4 (AB 4) is disconcerting. If passed, AB4 would extend health insurance coverage to all undocumented immigrants.

According to California officials, the state currently spends $9.5 billion on healthcare for undocumented immigrants. AB 4’s supporters argue that an additional program is necessary to cover those who earn more than Medi-Cal’s income threshold and are thus excluded from accessing the State’s Covered California Exchange.

To facilitate this coverage, the bill requires Covered California to establish a ‘parallel marketplace’ consistent with existing federal law that would expand healthcare coverage to the State’s undocumented immigrants no sooner than January 1, 2027.

The Exchange is subsequently required “to undertake outreach, marketing, and other efforts to ensure enrolment.” As currently written, the program would be funded through the General Fund. The authors of AB4 argue that the bill is necessary to achieve equity in health by “reducing disparities in access to health care among vulnerable and underserved communities.”

This bill expands a massive entitlement program that will become a huge financial burden for state residents in the years to come. Such an expansion is unwise even if the state were not facing a fiscally uncertain environment. Given the coming fiscal storm, adopting AB4 borders on reckless.

AB4’s Estimated Costs

In 2020, the estimated per capita healthcare cost in California was $10,299 per year. With an estimated 1.8 million undocumented residents in the state, this expansion would create an additional $18.5 billion in annual healthcare costs. Importantly, this estimate assumes that the offer of subsidized health insurance will not encourage more undocumented workers to relocate from other states to California. To the extent such incentives encourage additional undocumented immigrants to move from other states to the Golden State, the costs will be even higher.

If AB4 works like other programs for undocumented immigrants – such as the programs established in Colorado (OmniSalud Program) and Washington State (Cascade Care Savings) – the undocumented immigrants enrolled in the program will pay for some of these costs through monthly premiums and out of pocket costs. But they will also receive subsidies. If these subsidies equal the average ACA susbidy ($536 per month), then the state would be responsible for an additional annual expense of $11.6 billion.

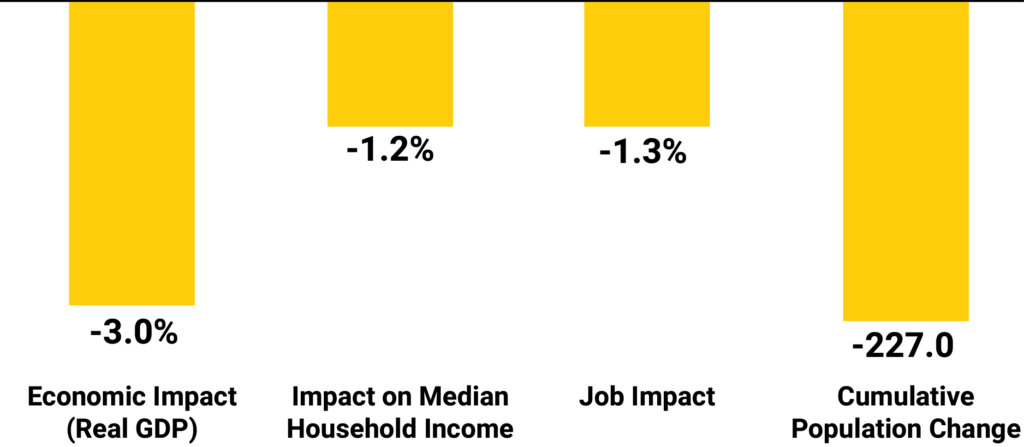

5-Year Economic Losses Compared to Baseline

(population change in thousands)

KEY TAKEAWAYS

- Expanding healthcare to undocumented immigrants could increase total state spending by $11.6 billion based on the average premium subsidy paid on ACA plans.

- Unless other government spending is reduced to offset these additional expenditures, covering the costs of AB4 would require a 1.5 percentage point increase in income tax rate for all taxpayers in the 8.0 percent tax bracket and above.

- Such a tax increase would reduce the growth in the average household’s income by nearly $1,500, reduce total job growth by nearly 350,000 and cause the economy to be more than 3 percent smaller than otherwise.

Raising an Additional $11.6 billion in Tax Revenues Imposes a High Economic Cost

Assuming that the state will not reduce spending on roads, education, or other healthcare programs to accommodate these increased costs, the state will have to raise taxes to finance the expanded entitlement program.

Assuming the state would fund the new spending with increases in the income tax, then a 1.5 percentage point increase in the tax rates of all taxpayers in the 8.0% tax bracket and above would raise enough money to cover the estimated costs – for 2024-2025, this means that taxes would be raised on single filers earning $55,866 or more and joint filers earning $111,732 or more.

Such a tax increase would weaken California’s economy. Over five years, it would mean that the average household’s income would be nearly $1,500 smaller, there would be nearly 350,000 fewer jobs created, and the economy would be more than 3 percent smaller than otherwise. The tax increases would also help accelerate the exodus of people leaving the state with an additional 227,000 people choosing to migrate to other states.