An Irresponsible FY2025-26 Budget All but Ensures Future Fiscal Crises

Wayne Winegarden

July 2025

Another fiscal year, another lost opportunity. In a June 2025 Spending Watch analysis, I lamented that Newsom was relying on gimmicks to close the current $12 billion budget deficit. The final budget the governor and legislative leaders agreed upon is even worse. It is the triumph of hope over reason, weakens the state’s fiscal position, and increases the likelihood that an even worse financial crisis awaits us next year. It closes the state’s budget deficit in name only. As Politico reported,

Democratic state lawmakers sought to stave off many of Newsom’s proposed cuts, turning instead to deferrals and borrowing from state reserves. They are banking on California’s economic outlook improving in future years, allowing the state to reduce the severity of the reductions.

Refusing to make tough but necessary budget choices is not fiscally responsible, nor is it compassionate to enact an unrealistic spending plan that will make painful cuts to core priorities and services for the vulnerable a reality in the not-too-distant future.

Specific gamesmanship includes tapping the state rainy day fund for $7.1 billion and other cash reserves for $6.5 billion. It also implements budget gimmicks such as shifting cap and trade funds and climate funds to pay for environmental costs that are supposed to be covered by the General Fund.

Perhaps most troubling, the agreed upon budget increases state spending when spending restraint is called for and the modicum of spending restraint that the governor proposed has been either watered down or eliminated completely.

Take Medi-Cal. The expansion of Medi-Cal is costing $8.5 billion annually. Rather than rolling back this unaffordable expansion, currently enrolled undocumented immigrants will remain on the program, re-enrollment will be allowed for another three months for those undocumented immigrants who allowed their coverage to lapse, and then monthly premiums will be a mere $30 starting in 2027. By enshrining a completely unaffordable program, this policy sets the state up for continued budget crises in the future.

The agreement also forgoes needed education spending control, another major expenditure category. While the governor originally proposed an 8 percent cut to the University of California and California State University systems, the budget agreement completely restores this funding. For perspective, California spends more per student in post-secondary education than most other states – $14,648 compared to a national average of $11,290.

KEY TAKEAWAYS

- The FY2025-26 final budget is another disappointment. Rather than establishing a fiscally responsible spending path, Governor Newsom and legislative leaders paper over the deficit with fund shifts, budget gimmicks, and withdrawals from the budget reserves.

- The budget fails to rein in the $8.3 billion expansion of Medi-Cal to undocumented immigrants or implement the Governor’s May Revise plan to reduce higher education spending despite spending 30 percent more per pupil than the average state.

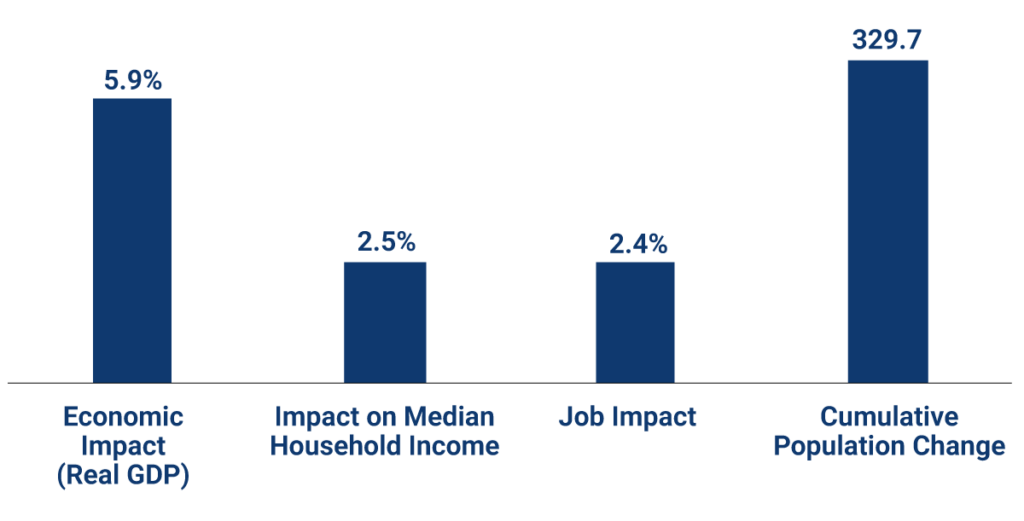

- Had California just maintained expenditures at the elevated share of personal income that existed in 2019 (8.2 percent), the state could have reduced taxes by $31 billion. This is sufficient to fund a 2-percentage point across the board income tax rate reduction with a 0% tax rate on the two lowest brackets. If this proposal were implemented, then, over five years, California’s economy could be nearly 6 percent larger than baseline, the median household’s income could be increased by more than $3,000, and nearly 700,000 additional jobs could be created.

The sheer size of the FY2025-26 budget is costing the state dearly. In 2024, total state funded expenditures equalled 9.8 percent of state personal income. Prior to the Covid pandemic, state funded expenditures typically averaged around 8.0 percent of income. Even if the state had maintained the 2019 above average spending level of 8.2 percent of income, total state expenditures would be around $290 billion or $31 billion smaller compared to the agreed upon budget.

5-Year Economic Gains Compared to Baseline

(population change in thousands)

Conclusion

The final FY2025-26 California Budget is a combination of irresponsible spending and budget gimmicks. By playing these games, the governor and legislative leaders are shirking their budget responsibility. Their gimmicks and fund shifts will only work, as Politico notes, if California’s economic outlook appreciably improves. It is the political equivalent of betting this year’s rent money at the Vegas blackjack tables. More likely than not, the trip to Vegas will end in despair. Even if you beat the odds, relying on luck and hope is not a sound financial strategy.

Unfortunately, yet not unsurprisingly, all our political leaders in Sacramento are offering is wishful thinking. California’s taxpayers deserve better.