Budget Gimmicks Will Not Solve

The State’s Fiscal Crisis

Wayne Winegarden

June 2025

It’s budget crunch time for Gov. Newsom and legislative leaders. The immediate problem is closing the estimated $12 billion budget shortfall for the FY2025-26 budget. Despite this serious fiscal challenge, the Governor’s budget proposal demonstrates an unseriousness regarding the state’s fundamental problems. More disheartening, even these inadequate proposals are too much for many legislators.

Whatever budget ultimately emerges from the negotiation process will speak volumes about the state’s future fiscal health. Should the budget reflect the governor’s priorities, it will indicate the state is ill prepared to address its structural flaws. The state will, consequently, continue to lurch from one crisis to the next as we gradually slide toward fiscal insolvency.

That’s the good news. Legislators are balking at many of these cuts and are considering further tax increases to balance the budget. Should they successfully inject greater taxes and spending into the budget, the fiscal situation will be even worse. California’s economic underperformance will accelerate, which will subsequently hasten the state’s ultimate fiscal reckoning.

Illusory Savings and Budget Gimmicks Won’t Do

to retain revenue from incremental fee structures. As a former OptumRx executive who helped establish Emisar [a rebate aggregator] explained, “[t]he intention of the G.P.O. [rebate aggregator] is to create a fee structure that can be retained and not passed on to a client.” (emphasis added)

KEY TAKEAWAYS

- Governor Newsom’s proposals to close the estimated $12 billion budget deficit relies on budget gimmicks and illusory savings. It is not a fiscally responsible plan.

- Examples of his budget gimmicks include anticipating that rebate aggregators can reduce Medi-Cal’s drug costs by $300 million even as the Federal Trade Commission (FTC) documents that these entities rarely save payers money. In another gimmick, the governor would shift $1.8 billion in education spending from fiscal year 2025-26 to FY2026-27, which only balances this year’s budget by unbalancing next year’s.

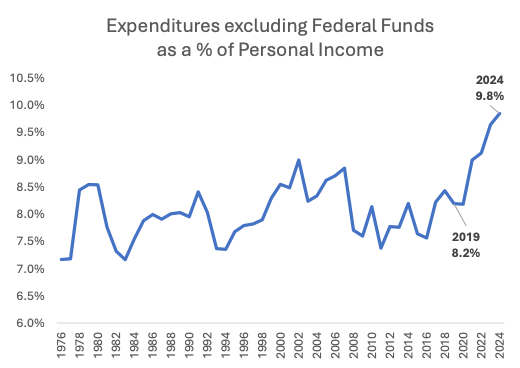

- California faces a long-term budget crisis – according to the nonpartisan Legislative Analyst’s Office (LAO), the budget deficit will be between $20 billion and $30 billion for the next three years. Because total state funded spending is at a historic high relative to state incomes, steep fiscal discipline is required to regain budget stability.

According to pharmacy benefits consultancy innovative Rx strategies, rebate aggregators often retain 15 percent of the rebates received as revenue. Due to this large cut, it is questionable whether aggregators have generated significant savings for many payers. These experiences undermine the governor’s estimated savings for Medi-Cal. Perhaps the savings will materialize, but such an outcome is far from certain based on the track record.

In another spurious health care savings idea, the governor anticipates the state realizing $75 million in savings from increasing Medi-Cal’s minimum rebate on drugs that treat HIV and cancer. On a static basis, applying a larger discount on the same list price of medicines will generate savings. The problem arises because the world is not static.

The proposal will likely raise funds in the upcoming budget year, but it does so at great costs to patients and total expenditures. The proposal will reduce patient access to innovative treatments and disincentivize further innovation. The reduced drug access will likely expand the number of more expensive hospital stays and surgeries that patients on Medi-Cal will require. Replacing expenditures on medicines with more expensive medical services is counterproductive from both a patient welfare and overall Medi-Cal cost perspectives. Considering the likely increase in Medi-Cal expenditures, the proposal improves the state’s fiscal position on paper only.

Higher future Medi-Cal expenditures are especially disconcerting because the state’s fiscal outlook will continue to worsen in the future – according to the LAO, the state will have to manage budget deficits between $20 billion and $30 billion over the next three budget years. The proposal to increase higher rebate savings will likely increase the future budget holes even further.

The governor’s budget gamesmanship goes beyond health care too. For example, with respect to education funding, the governor is proposing to defer “$1.8 billion in LCFF [local control funding formula] funding from June 2026 to July 2026.” The timing of this deferment is material because it occurs between the end of the FY2025-26 budget and the beginning of the FY2026-27 budget. Consequently, it balances the current budget by shifting $1.8 billion to the FY2026-27 budget. As the LAO already expects a $20 billion deficit in FY2026-27, the deferment merely kicks the problem down the road. While Newsom may be hoping that tax revenue growth will accelerate over the next year making these costs easier to bear in the future, hope is not a plan.

Conclusion

The governor’s vision for closing the current $12 billion budget deficit is unserious and fails to recognize the root cause of the problem – excessive government spending. Instead, he is offering policies that may balance the budget on paper but fail to create a fiscally sustainable budget. The implications for future state prosperity are dire, consequently, and Californians should prepare for continued budget volatility for years to come.