Recently, the Federal Trade Commission (FTC) held its first of three listening sessions on the pharmaceutical market. The goal was to discuss reforms that will improve drug affordability by increasing “generic and biosimilar availability” and promoting “competition”. Achieving these goals is essential.

The flaw of the first listening session is its focus on the ill-founded claims of “anticompetitive practices” by incumbent manufacturers. This focus demonstrates an inherent misunderstanding of the strengths and flaws of the current pharmaceutical market. Consequently, it will neither increase generic and biosimilar availability nor promote greater competition. It simply distracts from reforms that can meaningfully address the flaws driving actual drug affordability problems.

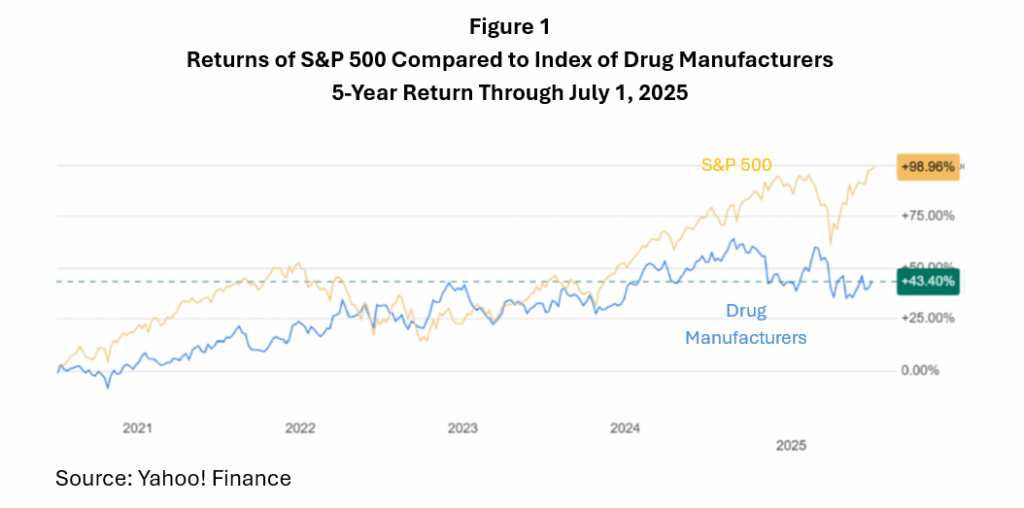

Drug Market Returns Are Average

The accusation being investigated is that innovative pharmaceutical manufacturers use anticompetitive practices to artificially extend their monopolies and earn unwarranted and outsized profits as a result. The data does not support such accusations.

Take the performance of the pharmaceutical stocks compared to the broader market. As Figure 1 illustrates, the value of the pharmaceutical sector has increased 43 percent over the past 5 years compared to a 99 percent increase in the value of the broader S&P 500. These market returns are inconsistent with an industry earning unwarranted monopolistic profits.

Nor is there evidence of monopolistic profits in the pharmaceutical industry’s returns. Adjusted for R&D expenditures, the pharmaceutical drug industry’s return on equity (ROE) (a common measure of profitability) as of January 2025 was 7.13 percent while the biotechnology industry lost 3.07 percent. The total ROE for the broader market was much higher at 13.66 percent.

While the industry’s relative profitability varies from year to year and across different income metrics, its profitability adjusted for the large research and development investments is consistently around the average for the total market at best. Therefore, there is no evidence of untoward monopolistic behavior in the industry’s profitability numbers.

Wayne Winegarden, Ph.D. is a Sr. Fellow in Business and Economics and the Director of the Center for Medical Economics and Innovation at the Pacific Research Institute