Covering Undocumented Immigrants Will Worsen The State’s Fiscal Crisis

Wayne Winegarden

May 2025

A previous Spending Watch analysis estimated the fiscal and economic impact of funding Medi-Cal benefits to undocumented immigrants. The analysis estimated that the expansion will require an additional $11.6 billion in expenditures, which will impose large economic impacts on Californians. The fiscal and economic risks to state residents have only increased since our analysis.

The “big, beautiful bill” that Republicans in Congress are currently negotiating creates the first risk. As part of this bill, Republicans are considering reducing the federal Medicaid payments to states that offer benefits to undocumented immigrants.

Should California continue to offer Medi-Cal benefits to this population, then the state could lose $4.4 billion according to Politico. Maintaining the benefits requires the state to backfill these lost revenues. Added to these revenues, maintaining Medi-Cal benefits to undocumented immigrants requires the state to continue paying its $11 billion annual bill for a total annual cost of $15.4 billion.

Given the state’s current $12 billion deficit, and the potential reduction in other federal money, maintaining these benefits will likely require significant tax increases. And advocates for these expanded benefits have publicly announced their support for implementing the necessary tax increases. For instance, as reported by the local Sacramento NBC affiliate, “Leaders of California’s Democratic Legislative Latino Caucus (recently) said everything should be considered in order to keep providing health insurance to undocumented immigrants, including a new tax on Californians.”

Medi-Cal Is Not Designed To Provide Universal Healthcare

Before addressing the pragmatic fiscal trade-offs involved, it is important to highlight an important foundational issue. Medicaid, which was established in 1965, was not designed to provide universal coverage. It is a safety net program designed to help low-income families, especially women, children, the disabled, and seniors. The program underpays doctors and hospitals, faces severe shortage issues, and has concerning issues regarding the quality of care. Expanding Medicaid’s scope without fixing these problems threatens the financial viability of healthcare practices and jeopardizes the sustainability of the program.

Further increasing costs on legal residents to fund benefits for undocumented immigrants raises further concerns. In a state were $100,000 is considered “low-income” in five counties, legislators should be working to improve the affordability for average families . Expanding these benefits does the opposite and feeds unwarranted opposition toward greater immigration.

KEY TAKEAWAYS

- Covering the healthcare costs for undocumented immigrants, accounting for the potential lost federal Medi-Cal revenues, requires around $15.4 billion, which is higher than our previous cost estimates for AB 4.

- Unless other government spending is reduced to offset these additional expenditures, covering the costs of expanding Medi-Cal to undocumented immigrants would require a 2.2 percentage point increase in the income tax for all taxpayers in the 8.0 percent tax bracket and above.

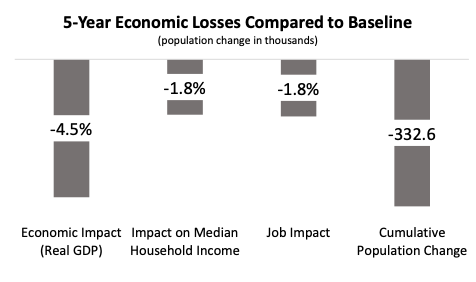

- Such a tax increase would reduce the growth in the average household’s income by nearly $2,200, reduce total job growth by nearly 500,000 and cause the economy to be 4.5 percent smaller than otherwise.

- Covering the healthcare costs for undocumented immigrants, accounting for the potential lost federal Medi-Cal revenues, requires around $15.4 billion, which is higher than our previous cost estimates for AB 4.

Raising an Additional $15.4 billion in Tax Revenues Imposes a High Economic Cost

This massive expansion in the state entitlement program could be accommodated by making significant reductions in the state’s spending on roads, alternative energy infrastructure, education, or other state priorities. And some of this spending, such as the billions of dollars spent on the bullet train or building electric vehicle charging stations, should be cut. However, it is inconceivable that the state legislature will enact $15.4 billion in spending cuts to pay for the increased Medi-Cal costs.

Just as with our assessment of AB 4, assuming that California legislators will not reduce spending to accommodate these increased costs, the state will have to raise taxes to finance the expanded entitlement program. Assuming policymakers would fund the new spending with increases in the income tax, then a 2.2 percentage point increase in the tax rates of all taxpayers in the 8.0% tax bracket and above would raise enough money to cover the estimated costs – for 2025-2026, this means that taxes would be raised on single filers earning $55,866 or more and joint filers earning $111,732 or more.

Such a tax increase would weaken California’s economy. Over five years, it would mean that the average household’s income would be nearly $2,200 smaller, there would be more than 500,000 fewer jobs created, and the economy would be nearly 4.5 percent smaller than otherwise. The tax increases would also help accelerate the exodus of people leaving the state with an additional 333,000 people choosing to migrate to other states.