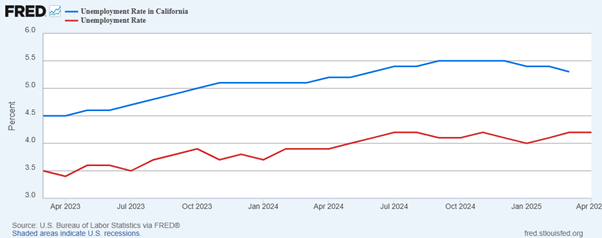

Currently, California currently ranks as the fourth-highest unemployment rate of any state (including the District of Columbia) in the nation, at 5.3 percent.

California’s unemployment rate steadily increased by a full percentage point between March 2023 and September 2024 and, despite continued economic growth, has plateaued ever since.

By contrast, the national unemployment rate has seen a smaller (0.6 percentage point) increase during the same period and now stands at 4.2 percent. That California hasn’t achieved an unemployment rate that low since October 2022 demonstrates the extent of its struggles in comparison to the national economy.

Figure 1: Unemployment Rate in California Compared to U.S. (March 2023-2025)

The state’s high unemployment figures are particularly concerning in light of fiscal difficulties that have led to payment delays for hundreds of thousands of unemployed Californians. In December last year, the Legislative Analyst’s Office released a damning report that described the State’s Unemployment Insurance (UI) Financing System as ‘broken.’

The COVID-19 pandemic placed an unexpected strain on California’s unemployment benefits system, but five years on from its outbreak, the LAO’s observation that the system is still struggling during a period of economic expansion is alarming.

Making matters worse, current unemployment tax receipts are insufficient to cover benefits and that shortfall will add to the state’s $20 billion UI-related debt to the federal government.

To shore up the system, the LAO recommended changes that would increase the cost of UI benefits to employers. Under the current system, employers contribute to UI benefits by paying a tax on only the first $7000 of their employee’s salary, at a rate determined by their lay-off history. However, under the LAO proposal to increase both the taxable wage base and the base UI tax rate, employers would be taxed at a higher rate on the first $46,800 of their employee’s salary. A hypothetical business would see their annual contribution for a worker making $50,000 rise from $140 to $1170 — an increase of over 730%

Higher payroll taxes, in theory, should incentivize employers to retain workers, but businesses who frequently lay-off workers are already paying a higher UI tax rate, and there would be diminishing marginal returns to increasing their taxes even more. Furthermore, raising the base tax rate undermines businesses who have done their best to minimize layoffs.

In other words, why would employers worry about retaining workers if they’re just going to pay a greater tax rate anyway?

Expanding the taxable wage base may help California pay off its debts and meet its obligations, but the net effect on employment is murky. For every worker who is retained, unemployed workers in industries with high turnover rates may be passed over by businesses that choose to automate tasks instead.

These issues would be best resolved by pro-growth policies that incentivize business to hire workers and eliminate the need for the state to pay UI benefits in the first place.

In the absence of such policies, however, unemployment will remain high and California will continue to struggle.

Nikhil Agarwal is a Pacific Research Institute research associate.