CalPERS has one core social responsibility – maximizing returns to help secure the retirement of millions of current and future pensioners. The pension fund is also a major proponent of Environmental, Social, and Governance (ESG) investing. CalPERS claims that ESG “disclosures provide important metrics to understand how a company’s practices could impact future financial performance. CalPERS uses an ESG framework to assess potential risks to our investments.”

In previous work, here, here, and here, PRI has raised questions regarding the viability and adverse consequences from ESG investing. CalPERS’ latest investment performance results provide more reasons to be skeptical.

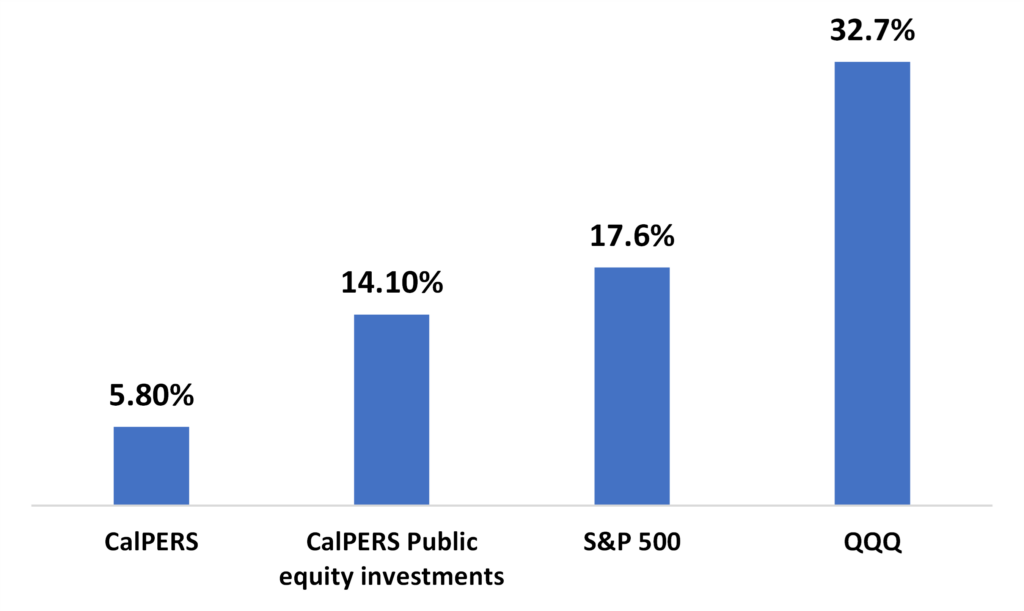

According to the press release announcing their latest performance, “CalPERS reported a preliminary net return of 5.8% on its investments for the 12-month period ending June 30, 2023.” Such a return does not compare well with the broader market.

CalPERS has investment in other assets, such as real estate, which provide important diversification benefits for the fund but performed poorly over the past year. To ensure an apples-to-apples comparison, Figure 1 includes CalPERS’ net returns and its returns on the fund’s public equity investments, which was a much higher 14.1 percent. However, even if only the public equity funds returns are considered, their performance paled in comparison to the 17.6 percent return in the S&P 500 over the same period or the 32.7 percent return in the QQQ (an index of 100 large NASDAQ stocks).

Figure 1

Net Returns: CalPERS Compared to S&P 500 and QQQ

12-months Through June 30, 2023

In response to this underperformance, ESG proponents could argue that returns over a short period of time may not reflect long-term performance. Everyone can have a bad quarter or a bad year, after all. But such a defense does not apply in this situation.

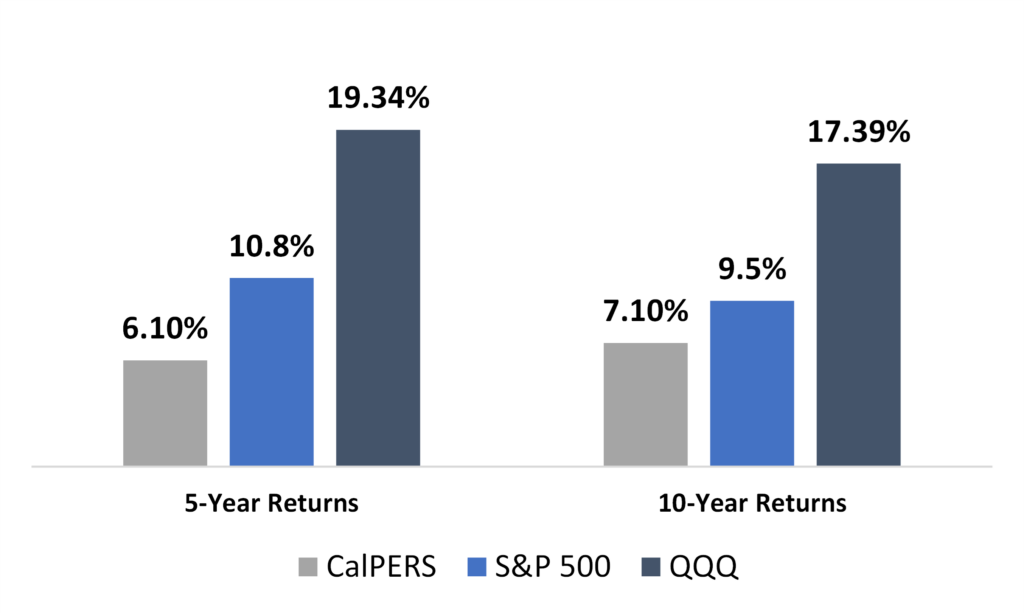

CalPERS has had a long-term underperformance problem compared to these key financial benchmarks, see Figure 2. Figure 2 compares CalPERS’ net returns to the returns of the S&P 500 and QQQ index over longer 5-year and 10-year periods. Even over these longer periods of time, CalPERS’ financial results have been a disappointment. In fact, pensioners would have been better served had CalPERS simply passively invested pensioners assets into broad-based index funds. It would have been a lot less costly for pensioners too.

Figure 2

Net Returns: CalPERS Compared to S&P 500 and QQQ

5-Year and 10-Year Through June 30, 2023

These results do not prove that ESG caused CalPERS to underperform, but they do demonstrate that the fund’s ESG programs did not enhance risk-adjusted returns. Since there are costs associated with managing ESG programs, the inability to outperform demonstrates that CalPERS’ support of ESG is likely imposing a net burden on current and future pensioners.

Having followed ESG investment performance for many years now, the conclusion that ESG imposes a net cost on a pension fund should not be surprising. Yet somehow it still is. Perhaps more important, by imposing a net burden, ESG is making it more difficult for CalPERS to serve its vital social purpose. Unfortunately, the irony of this outcome seems to be lost on the proponents of ESG.

Dr. Wayne Winegarden is a senior fellow in business and economics at the Pacific Research Institute.