Neither political party has been fiscally responsible as of late. The last fiscally responsible President was Bill Clinton who, in his 1996 State of the Union Address, declared that “the era of big government is over”. Today, it is the era of small government that is over, which (demonstrating how far to the left the Democratic party has moved) Bill Clinton would likely declare today – and happily so.

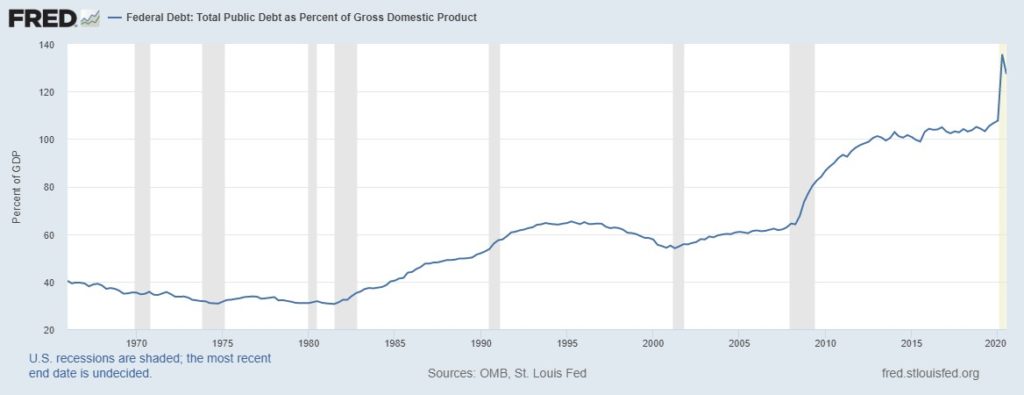

While it is the spending not the debt that matters, the rising debt levels relative to the economy provides a convenient shorthand that demonstrates how bad the spending problem is.

Comparing the total public debt relative to the size of the economy (or GDP), spending discipline started to erode with President Bush in 2000, accelerated under President Obama, continued growing under President Trump until the Covid-19 pandemic exploded the debt to unprecedented levels. Total debt is now more than 120 percent of the size of our entire economy.

The 120 percent level is just the beginning. Since that time, President Biden has spent $1.9 trillion in the third (or is it fourth? Perhaps it is the fifth?) Covid-relief bill. And now, President Biden is “readying a multi-part $3 trillion infrastructure package”. Relative to the current size of the economy, financing all of these expenditures with debt will push the debt to GDP ratio up to a staggering 150.4%.

PRI’s multi-part study Beyond the New Normal demonstrated that when government spending exceeds the private sector’s ability to pay for these costs, economic growth suffers. A 2013 study by the World Bank examining the impact from excessive government debt confirms our results.

The World Bank study found that a debt to GDP ratio over 77 percent is troublesome, and that “each additional percentage point of debt costs 0.017 percentage points of annual real growth.” Based on this relationship, the current level of debt is reducing our annual growth rate by 0.85 of a percentage point a year. Including all of the new spending, growth will be a full 1.25 percentage points below its potential.

Of course, instead of debt, the increased government spending could be covered by raising taxes, which seems to be the Biden Administration’s intentions. Tax increases reduce economic growth, so whether financed with debt or taxes, economic growth is sure to suffer if these spending plans continue to be implemented.

However, President Biden has promised that tax increases would only be imposed on those families earning over $400,000 a year. Assuming $400,000 means $400,000 (not $200,000 if you are not married), then this promise is an illusion.

Extrapolating from the data maintained by the IRS, the nearly 4 million households with an adjusted gross income (AGI) greater than $400,000 paid approximately $600 billion in income taxes in 2018. Assuming the $3 trillion President Biden wants to spend will be spread evenly out over 5 years, the federal government would need to double the amount it confiscates from the wealthiest families just to cover the costs of the infrastructure spending. Doubling the amount of tax revenues raised from the richest families is infeasible – certainly in the long-run.

Further, the government would still be running trillion-dollar deficits for all of its current spending. On top of these expenditures, Medicare would still be going bankrupt. Social Security would still be insolvent. State and local pensions will still be underfunded. And, due to all of the additional spending, the economy will grow at an even slower rate, making it more difficult to solve these structural problems.

This basic arithmetic demonstrates that the U.S. cannot afford another bout of tax (or borrow) and spend. The U.S. faces a looming fiscal crisis. The sooner we recognize our dire fiscal state, and recognize that spending is the problem not the answer, the smaller the ultimate cost will be.