You may have missed it amidst the “vote-a-rama” on dozens of amendments to the Senate Democrats’ $3.5 billion budget reconciliation bill being voted on early Wednesday morning, but a key bipartisan vote could put an end to what PRI has termed “costly subsidies for the rich,” or taxpayers subsidizing electric car subsidies for wealthy car buyers.

As I have written about previously, the Biden administration – inspired by California’s expensive green agenda – wants to expand taxpayer-funded subsidies to purchase electric vehicles. Biden’s initial “American Jobs Plan” proposed spending $100 billion on electric car subsidies (click here to see how California has “been there, done that” on electric car subsidies).

While the bipartisan infrastructure plan that the Senate passed this week doesn’t include the $100 billion in funding, it kicked the debate to the budget reconciliation process.

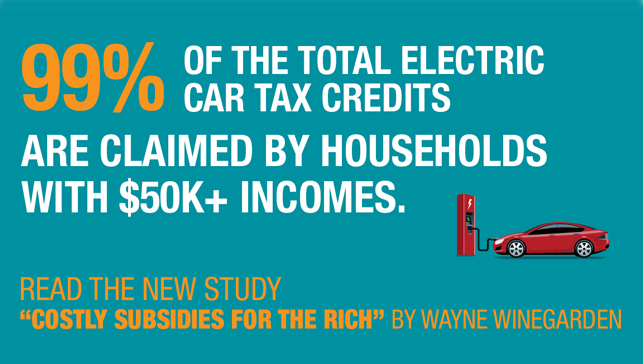

In his research that has garnered national attention, PRI’s Wayne Winegarden documented that 79 percent of electric vehicle plug-in tax credits were claimed by households with adjusted gross incomes of greater than $100,000 per year. Households with incomes greater than $50,000 per year claimed 99 percent of the credits.

Winegarden says, “when politicians talk about the need to subsidize costly electric cars, they fail to tell you that the subsidies that taxpayers are paying for are just another giveaway to the wealthy.”

“Taxpayers should start asking elected officials what benefit we are getting from these expensive subsidies that only benefit upper-income households,” he says.

Elected officials are finally listening.

U.S. Sen. Deb Fischer, R-Nebraska, introduced an amendment to the Democrat budget reconciliation bill “to ensure high-income individuals do not get government subsidies to buy expensive luxury cars.” Specifically, her amendment disallows electric vehicle tax credits from being claimed for individuals making more than $100,000 per year, or if the car being purchased cost more than $40,000.

Citing Winegarden’s research in her speech on the Senate floor, Fisher noted that, “everyday Americans are living paycheck to paycheck because of the sharp rise in costs due to inflation.”

She said that proponents, “want to subsidize luxury vehicles only the rich can afford using money from hard-working taxpayers and my amendment would put a stop to that.”

Writing about the debate, Politico noted that “three Democrats thought that was a good question” why government would “subsidize luxury vehicles for the wealthy.”

They joined with nearly all Republican senators in a surprising bipartisan vote to pass the amendment, by a margin of 51 to 48.

While it’s far from a settled issue whether this long-overdue policy change will be enacted into law – and there are many twists and turns ahead in the debate over budget reconciliation – the bipartisan Senate vote represents an important step forward toward ending “costly subsidies for the rich” once and for all.

Tim Anaya is the Pacific Research Institute’s senior director of communications and the Sacramento office.