Single Payer Will Worsen California’s Healthcare System and Reduce Economic Growth

Wayne Winegarden

March 2024

With the introduction of AB 2200, advocates are, once again, proposing that California adopt a single payer healthcare system. Ostensibly, their proposed CalCare system would streamline payments, lower per-capita spending, guarantee “quality health care and long-term care,” and eliminate “out-of-pocket costs.”[1] Further, proponents say the taxes imposed by the state would equal the money that would have been spent on healthcare, resulting in no adverse economic consequences. The evidence does not support these claims.

Whether it is Medicaid, Medicare, or Veteran’s healthcare in the U.S., or the fully socialized healthcare systems in Canada and the U.K., past experiences demonstrate that state-run single payer healthcare systems are less efficient. If adopted in California, the consequences would be reduced healthcare quality, rationed care, and weakened economic prosperity.

Adverse Economic Impacts

Adding together Medicare, Medi-Cal, and private healthcare expenditures, Californians spend an estimated $400 billion annually on healthcare.[2] Previous analyses claim that the government funds about one-half of these revenues, requiring an additional $200 billion in state revenues to fund single payer.

Regardless of whether the higher tax payments equal the current healthcare expenditures, there will be negative economic consequences from raising marginal income tax rates. Although the latest iteration of CalCare in AB 2200 does not have a finalized funding plan, a prior version, Assembly Constitutional Amendment 11 (2022), proposed a 2.3 percent gross receipts tax on business revenues of more than $2 million, a 1.25 percent tax on California-based employees in companies with 50 or more people, and a series of progressively higher marginal tax rates on higher income families.[3]

Even under the generous assumption that the diminished purchasing power of consumers and businesses due to the higher taxes are offset by their lower healthcare expenditures, the average family will still be worse off. Imposing higher tax burdens on a subset of businesses and higher income taxpayers will discourage investment, encourage higher income individuals to leave the state and incentivize businesses to expand operations outside of California. In-state employment and income growth will suffer as a result.

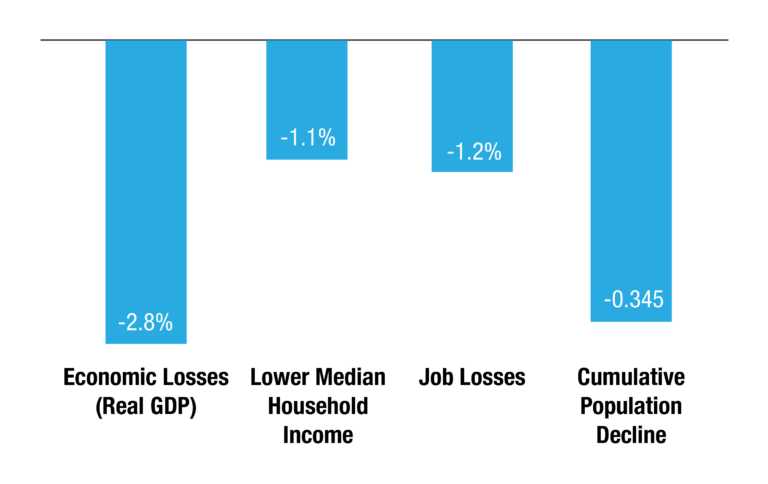

Accounting for the elimination of private healthcare expenditures, the larger economic disincentives created by the higher marginal income tax rates on individuals and businesses would cause California’s economy to be 2.8 percent smaller than the expected baseline in five years, based on PRI’s Tax and Budget Model. Additionally, there would be over 332,000 fewer jobs, the average household’s income would be $1,200 smaller than otherwise, and the population would decline by an additional 345,000 people.

5-Year Economic Losses Compared to Baseline

(population decline in millions)

Illusory Savings

Government run healthcare systems generate savings by imposing price controls that undercompensate healthcare providers. Medicaid and Medicare exemplify this outcome. Compared to Medicare, state Medicaid programs underpay doctors and physicians by around 30 percent and undercompensate hospitals by around 22 percent – Medi-Cal’s reimbursement rate being around the national average.[4]

Putting Medicaid’s uneconomical compensation into greater perspective, Medicare underpays hospitals by more than half and physicians by nearly one-third compared to private insurance.[5]

Like Medicaid and Medicare, CalCare would generate savings by underpaying healthcare providers. Without the ability to transfer these costs over to patients with private insurance, which is what occurs today, doctors and medical professionals will have an incentive to join the exodus of businesses and high-income residents and flee California to practice medicine in more favorable climes. The decline in medical professionals will lead to access issues.

As with all “free” goods, CalCare would also incentivize patients to overuse healthcare. Faced with surging patient demand and declining numbers of providers, the state will inevitably impose strict access restrictions that will result in patients having less access to innovative therapies, longer wait times for procedures, and even restrictions on the types of procedures they can receive. In short, patients will receive worse healthcare.

There’s a Better Way

California can improve health outcomes, broaden access, and encourage economic growth without CalCare. Instead of applying for a Medicaid waiver to socialize healthcare, California should apply for a waiver that replaces the state’s sub-par Medi-Cal program with a program that empowers all patients to purchase health insurance with pre-tax income and cover their out-of-pocket costs with tax free savings accounts.

Current federal and state Medi-Cal spending per enrollee is around $7,700, which is nearly the average employer spending for single coverage of $8,400.[6] This shows that there are sufficient funds to create an effective healthcare safety net that ensures families can purchase high quality health insurance. This approach can better fulfill universal coverage aspirations without worsening the current troubled healthcare system or imposing additional anti-growth tax increases.

[1] Assembly Bill 2200, https://a25.asmdc.org/sites/a25.asmdc.org/files/2024-02/AB%202200%20-%20CA%20Guaranteed%20Health%20Care%20for%20All%20Act_fact%20sheet_2-7-24.pdf.

[2] AB 2200 CalCare: Frequently Asked Questions, https://a25.asmdc.org/sites/a25.asmdc.org/files/2024-02/AB%202200%20CalCare%20FAQ_2-7-24.pdf.

[3] https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202120220ACA11

[4] Zuckerman S, Skopec L, and Aarons J “Medicaid Physician Fees Remained Substantially Below Fees Paid By Medicare In 2019” Health Affairs, February 2021, https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2020.00611. “Medicaid Hospital Payment: A Comparison across States and to Medicare” MACPAC Issue Brief, April 2017, https://www.macpac.gov/wp-content/uploads/2017/04/Medicaid-Hospital-Payment-A-Comparison-across-States-and-to-Medicare.pdf.

[5] Lopez E, Neuman T, Jacobson G, and Levitt L “How Much More Than Medicare Do Private Insurers Pay? A Review of the Literature” Kaiser Family Foundation, April 15, 2020, https://www.kff.org/medicare/issue-brief/how-much-more-than-medicare-do-private-insurers-pay-a-review-of-the-literature/.

[6] Kaiser Family Foundation, https://files.kff.org/attachment/fact-sheet-medicaid-state-CA, and https://www.kff.org/report-section/ehbs-2023-section-1-cost-of-health-insurance/.https://a25.asmdc.org/sites/a25.asmdc.org/files/2024-02/AB%202200%20-%20CA%20Guaranteed%20Health%20Care%20for%20All%20Act_fact%20sheet_2-7-24.pdf

KEY TAKEAWAYS

- Raising taxes to fund single payer healthcare will harm the economy. Based on the tax increases proposed to fund prior versions of CalCare, economic growth will be at least 2.8% less, there will be 333,000 fewer jobs, average incomes will be $1,200 smaller, and an additional 345,000 people will leave the state.

- Single payer healthcare in California will create new access problems and additional barriers to care.

- Reforms that empower patients and subsidize low-income families can improve healthcare quality and better fulfill universal coverage aspirations.