Spending Watch: California’s Budget Delusion

Wayne Winegarden

January 2026

Governor Newsom has released his final state budget and for the fourth year in a row, the state is facing a large budget deficit that it must close. This prolonged period of persistent budget deficits was entirely predictable.

For the upcoming FY2026-27 budget, that deficit is estimated to be $18 billion according to the Legislative Analyst’s Office but a much smaller $3 billion deficit according to the Governor. The large discrepancy arises because the Governor is relying on excessively optimistic revenue assumptions, which allow him to sidestep many of the difficult budget decisions that must be made.

Of course, the Governor is not positioning his budget as such. In the official budget announcement he claims that due to “the very real risks of out-year deficits, rather than overextending new commitments, the budget prioritizes implementation of existing investments, fiscal restraint, and long-term planning.”

This statement clearly demonstrates that the Administration fails to recognize the state’s dire fiscal position. Spending is already unaffordable (the Governor inaccurately refers to spending as investments) and needs to be reined in – the budget shows insufficient fiscal restraint. Further, despite its claims to the contrary, the proposed budget demonstrates inadequate consideration for future budgets. If implemented, the Governor’s budget will make large out-year deficits more likely.

Unaffordable Spending and Insufficient Fiscal Restraint

Despite the protests against the modicum of discipline, deficits continue to plague the budget because the state spending burden remains excessive. Historically, total state expenditures (excluding federal funds) averaged around 8.1 percent of the total income of the state. While down from its high of 9.9 percent in 2024, expenditures are still around 9.0 percent of income.

Establishing long-term budget stability requires the state to – at bare minimum – bring expenditures back in line with the historical average. The goal of establishing an affordable budget will not be achieved by increasing total state spending across all funds by nearly 9 percent in the coming fiscal year, which is what the proposed budget would do.

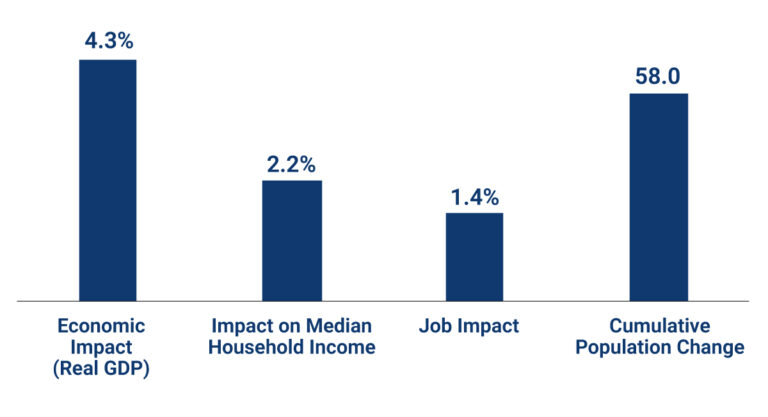

This excessive burden imposes a real opportunity cost on the state. For instance, bringing state expenditures down to their historical average would enable an across the board 1.5 percentage point income tax cut. Such a significant tax reduction would increase the size of the economy by 4.3 percent over five years, accelerate the growth in the median household’s income by over $2,700, and create over 280,000 additional jobs. It would also help alleviate the exodus of people leaving the state.

KEY TAKEAWAYS

Governor Newsom’s last budget offers more of the same. It relies on short-term fixes to address the state’s long-term budget problems.

The January budget over-optimistically assumes that the revenue surges associated with the AI economy will persist. When coupled with the billionaire exodus caused by the potential 5 percent wealth tax, the state is at risk of even larger deficit problems over the next several budget cycles.

Imposing spending discipline could enable an across the board 1.5 percentage point reduction in income tax rates that would increase the average household’s income by over $2,700, increase total job growth by more than 280,000 and cause the economy to be 4.3 percent larger than otherwise.

5-Year Economic Impact Compared to Baseline

(population change in thousands)

Volatile Revenues Inevitably Create Budget Instabilities

The budget’s approach to the revenue side of the ledger is just as troubling. The Governor notes that there has been “a welcome surge in state revenues in 2025” but then goes on to claim that it “reflects a boost in the overall revenue outlook.” He is, consequently, falling into the revenue volatility trap.

The “revenue surge” refers to the increased income tax revenues that the state has been receiving in 2025 due to the AI revolution. This sudden and large increase in revenues is a familiar tale. Stock prices of technology companies rise because of the perceived potential of the latest innovative technologies – in this case artificial intelligence. As the tech workers realize some of these capital gains, there is a large (but temporary) increase in incomes and subsequently tax revenues.

Assuming this revenue surge creates a sustainable improvement in the fiscal outlook fails to learn from state history. As Newsom consistently reminds us, California’s revenues are volatile and managing that volatility is essential. Spending the entire revenue windfall in the current fiscal year is not responsibly managing the volatility. It is falling into the same old trap, which will ultimately result in future budget crises.

Inadequate Consideration of the Future

Then there are the mounting future problems. In the near future, the Governor notes “the dominant risk to the budget is stock market and asset price declines—shocks that disproportionately impact high-income earners.”

This is no small risk – the top 1 percent of income earners, around 175,000 taxpayers, pay around half of the state’s total income tax revenue. It also demonstrates that Newsom recognizes that the AI revenue windfall is temporary, he is just hoping the windfall will last long enough to solve the temporary budget shortfalls. Hope is not an effective plan.

Worsening this outcome, there are growing signs of economic instability. The December 2025 employment report showed that job growth is stagnating. In California, the employment situation is even worse. The weakening labor market is an ominous sign for the state economy and, subsequently, state tax revenues.

The mere possibility that a wealth tax could be implemented has already driven away significant capital from the state. Larry Ellison (net worth $362.6 billion), Larry Page (net worth $208.8 billion), and Sergey Brin (net worth $193.7 billion) have all moved to other states because of the potential wealth tax – an issue we will address (once again) in a future analysis. The state’s proclivity to “tax the rich” is now driving away additional tens of millions of dollars in income tax revenues just when the state needs them, and these impacts do not even account for the lost entrepreneurship and investment which will deprive the state of the economic growth needed to revitalize prosperity.

As a final concern, the budget projects that the state will still face “a deficit of roughly $22 billion in the 2027-28 fiscal year and shortfalls in the two years following.” While claiming they are proposing a responsible budget that puts the state on a sustainable fiscal path, the acknowledged existence of future deficits demonstrates the exact opposite. While promising to address these deficits with the May revision, such promises have been made over the past four budget cycles. Budget deficits have persisted, nevertheless.

Conclusion

Californians have had to endure years of budget crises because the Governor and legislators have not stepped up to address the budget’s fundamental problems. Instead, the approach has consistently been to use budget gimmicks and fund shifts to paper over the deficits. As is inevitable, these budget games do not solve the problem. They only create larger issues that must be managed in the future.