The Taxing Wealth Tax

Wayne Winegarden

February 2026

To his credit, Governor Newsom is vowing to stop the wealth tax. As we noted in our response to Governor Newsom’s January budget, just the possibility that a 5 percent wealth tax will appear on the November ballot is having a chilling effect on California’s economy and state budget.

The tax, which would be retroactive to January 2026, has already driven away wealth. This lost wealth is damaging California’s economy even though the measure has not even qualified for the ballot. Our previous evaluation of the wealth tax examined these revenue and economic impacts. But the loss of current billionaires is only one of the many adverse consequences from the proposal. Another troubling impact is the damage that the proposal will inflict on California’s entrepreneurial economy.

California’s tech sector, for instance, accounts for 19 percent of California’s economy. Including the positive impact all that spending has on other parts of the economy, the tech sector directly and indirectly creates 30 percent of the state’s annual economic output.

The wealth tax jeopardizes the growth in this activity.

Wealth Taxes Drive Away Future Economic Activity

Why would the founders of the next Apple, Google, or Nvidia establish their businesses in California and risk the state expropriating a significant chunk of their wealth? Locating new businesses in Texas or North Carolina, which have vibrant technology clusters but have not demonstrated a willingness to expropriate people’s wealth, will look much more favorable. This lost economic activity would severely depress future economic growth.

To get a sense of what’s at risk, the Legislative Analyst’s Office (LAO) published a December 2025 analysis that examined the percentage of income tax withholdings that are funded by technology companies’ stock compensation. Total tax withholdings account for around 70 percent of the total personal income tax revenues raised in each year.

According to the LAO, “overall state income tax withholding from stock pay at California technology companies appears to be holding steady at about 10 percent of total income tax withholding. This amounts to roughly $10 billion annually in stock pay income tax withholding payments.”

The wealth tax, beyond chasing away current billionaires – along with their economic activity and income tax revenues – will also encourage future wealth to accrue to individuals living in states other than California. This means that, at current rates, the state is risking the loss of up to $10 billion in income tax revenues along with the resulting economic activity that would have occurred.

KEY TAKEAWAYS

- A California wealth tax would impose large economic costs beyond those created by the exodus of billionaires.

- California’s economy is driven by entrepreneurship, particularly technology entrepreneurs. A wealth tax stifles this vibrant sector that already drives up to 30 percent of the economy.

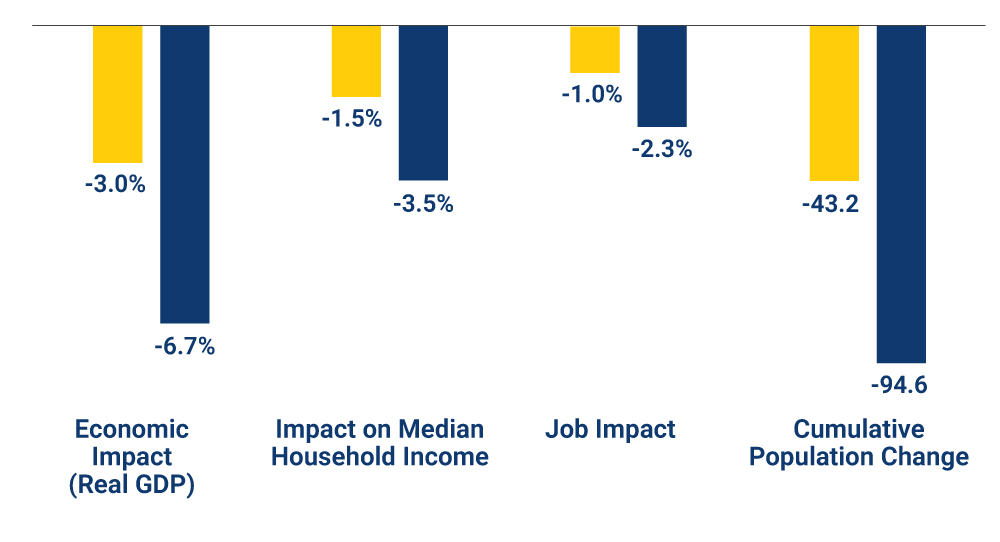

- A partial accounting of the consequences from a less vibrant entrepreneurial economy demonstrates that the tax could shrink the size of California’s economy between 3.0 percent and 6.7 percent, reduce the growth in the average household’s income between $1,900 and $4,300, diminish the growth in jobs between 200,000 and nearly a half million, and accelerate the exodus from the state between 43,000 and 95,000 people.

Regardless of whether the state accepted the loss of these revenues, there would be significant economic losses due to the entrepreneurial disincentives the legislation creates. The losses would be larger, however, if legislators tried to replace these lost income tax revenues that would require an across the board 1.25 percentage point increase in the state’s personal income tax rates.

Based on PRI’s economic and tax model, the size of California’s economy could shrink between 3.0 percent and 6.7 percent relative to the baseline. Further, the growth in the average household’s income would be between $1,900 and $4,300 smaller, the growth in jobs would between 200,000 and a half million less, and the exodus of people from the state would increase between 43,000 and 95,000.

5-Year Economic Impact Compared to Baseline

(population change in thousands)

Lost State Entrepreneurship Worsens the Losses

These consequences do not fully account for the losses due to the lost entrepreneurship. Entrepreneurship is hard to quantify and compounds over time. Discouraging new innovations reduces the long-term growth path of an economy – particularly one as vibrant and innovative as California.

To get a sense of how much larger these additional potential losses from a less innovative economy, consider the lost economic activity that would have occurred had California’s real growth rate, which averaged 3 percent annually between 1998 and 2024, was just one-half a percentage point smaller over this period. This lower growth state would mean that California’s total economic activity would by 12 percent smaller today than it is.

A full one-percentage point reduction in the state’s annual growth rate – around one-third of the state’s historical growth rate – would have caused the state’s economy to be 22 percent smaller today than it currently is. These calculations demonstrate how a seemingly small reduction in the state’s annual economic growth rate will have large impacts over time. The wealth tax risks such an outcome.

All this reduced growth means that families’ incomes would be lower and there would be fewer job opportunities. Ironically, compared to the goals of the wealth tax advocates, the less vibrant economy would also mean that the state’s budget would be smaller as well.

Conclusion

Wherever tried, wealth taxes have been a failure. Rather than creating a viable revenue source that strengthens the economy, these taxes reduce prosperity and undermine economic vibrancy. Californians should reject this destructive tax.