Reparations: A Financially Unrealistic Proposal That Will Bankrupt California

Wayne Winegarden

February 2024

With the introduction of its first set of reparations bills, the California legislature is officially considering the recommendations of the California Reparations Report from the state Reparations Task Force.1 Given these introductions, it is imperative to understand the financial implications. Some basic arithmetic demonstrates that the idea of reparations is fiscally unrealistic.

According to the U.S. Census,2 there are 2.5 million “black or African Americans” currently living in California. CalMatters estimates that 80 percent of the current black or African American residents would be eligible for reparations.3 Further, based on the California Reparations Report, CalMatters estimates that reparations should pay $1,381,198 to each eligible person, which does not even include estimates for the unjust property taking issues that the Commission could not estimate due to data constraints.4 Paying 2 million people $1.4 million each creates a $2.8 trillion reparations bill.

This dollar figure is approximately 72 percent of the state’s entire economy, so presumably the Legislature would not consider paying this sum in one year. Assuming the state takes 30 years to pay out the reparations, and ignoring inflation and the time value of money, the annual state cost would be $93.3 billion. However, the value of $93.3 billion paid over 30 years is less than the value of 2.0 million people getting $1.4 million today. To ensure that the value of reparations over 30 years equals the value of receiving $1.4 million today, the annual cost would be $182.0 billion.

To put these excessive sums in perspective, Governor Newsom’s total recommended state expenditures for the 2024-25 budget are $291.5 billion. Reparations would either expand total spending by between 32.0 percent and 62.5 percent (an unprecedented expansion of state government) or require a radical reduction in all other expenditures.

As a radical reduction in the state budget is unlikely, the Legislature’s more likely response would be to raise taxes to fund most of the reparations. However, the necessary tax hikes would need to be more extreme than any increase in state history.

Since no specific proposal to fund reparations has been suggested, we leverage PRI’s Tax and Budget Model to analyze the impacts from a broad-based tax increase assuming the policy is implemented in 2025. For conservative purposes, it is assumed that the Legislature will not attempt to account for inflation or the time value of money so the tax increases only need to raise $93.3 billion. Accounting for the estimated negative economic impact from the increase, a 3.25 percentage point increase in California’s three major taxes – income taxes, sales taxes, and corporate income taxes – would potentially raise $94.9 billion.

We use the term “potentially raise” because the increases would need to be so large that the historical economic relationship between rising tax rates and declining economic output likely understates the actual economic impacts. Even these understated impacts portend severe consequences.

To put the tax increase in perspective, the average California household (median) earned $85,300 in 2022.5 Based on the current income tax brackets, reparations would impose a more than 54 percent increase in their marginal state income rate and state sales tax burden!

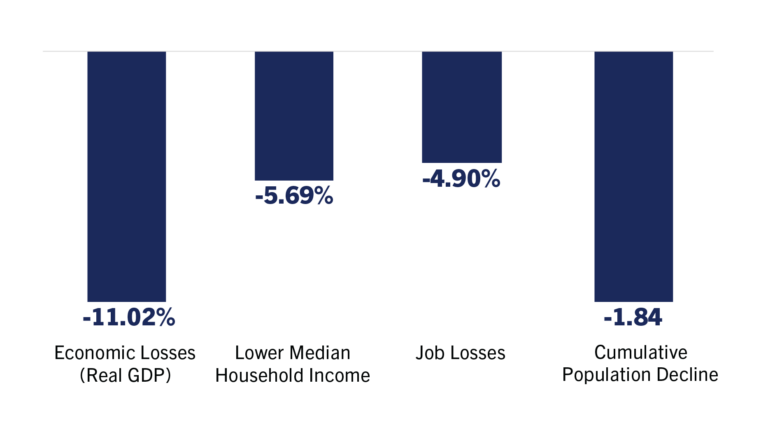

Californians will also endure large economic costs that will harm the state’s lowest income families the most. Compared to California’s baseline growth, the economy in 2029 would be 11 percent smaller, the average family’s income will be 5.7 percent smaller, and there will be 4.9 percent fewer job opportunities. The slower economy and higher tax burdens will also accelerate the current declines in the state population. By 2029, California would lose 1.8 million residents, including the huge increase in people seeking a better lifestyle in other states rather than California.

Reparations Will Bring Major Declines to California

(5-year economic losses compared to baseline; population decline in millions)

These costs will occur if the reparations are paid in cash or through in-kind services such as free tuition. Assuming professors will not teach pro bono, and utilities won’t provide electricity free of charge, then someone will have to cover those costs. That someone is taxpayers. Therefore, the economic consequences cannot be ameliorated by providing services for no charge rather than cash.

This fiscal unrealism is not reduced by taking an incremental approach to reparations, either. For instance, State Sen. Steven Bradford is advocating to set aside $1.5 billion this year and then 0.5 percent of the budget annually.6 However, these expenditures are meant to be a “down payment” on the full cost of reparations as outlined above.

Ultimately, reparations would make the California Dream more elusive and would impose the largest burdens on the poorest residents who are least able to bear the costs.

Unlike reparations, there are many policies that the legislature can implement that will create prosperity and improve affordability for all California families including African Americans. These include repealing AB 5 to increase work opportunities in the gig economy, implementing school choice to improve education outcomes, and reforming CEQA and local zoning regulations to lower the cost of housing.

While not explicitly targeted toward black Californians, these policies will expand opportunities and incomes broadly speaking, particularly for lower-income households. Incentivizing broad-based prosperity is the best way to help African Americans and all Californians achieve the American Dream.

KEY TAKEAWAYS

Estimated cost of reparations: $2.8 trillion (based on $1.4 million payout for 2 million people)

Impact on average California household: 54 percent increase in marginal state income tax rate and sales tax burden; 5.69 percent lower household income (over 5 years)

Accelerated outmigration: Would lead to 1.84 million people leaving the state over 5 years

Economic contraction: Would cause the economy to be 11 percent smaller and 4.9 percent fewer jobs over 5 years compared to baseline growth.