Governor Newsom has announced his stimulus plans for the state economy, the “Equitable Recovery for California’s Business and Jobs” plan. While increased support to those who are harmed is necessary, neither California nor the U.S. require an economic stimulus, as traditionally defined.

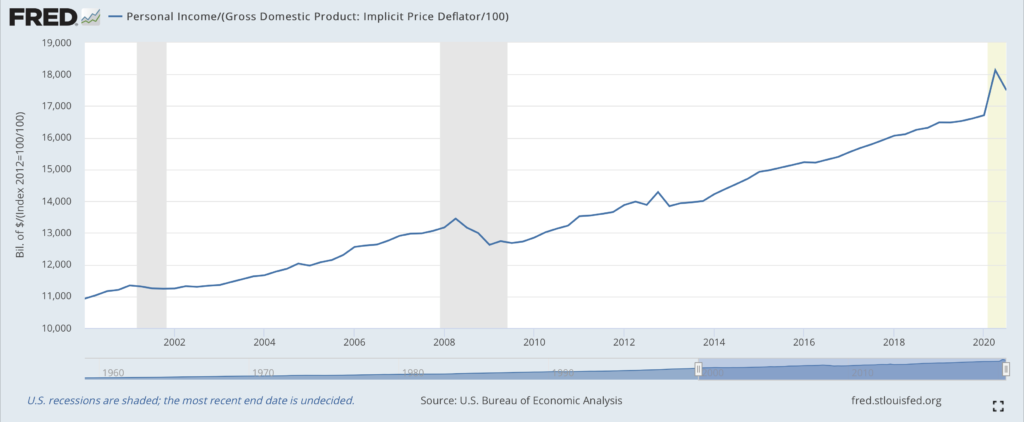

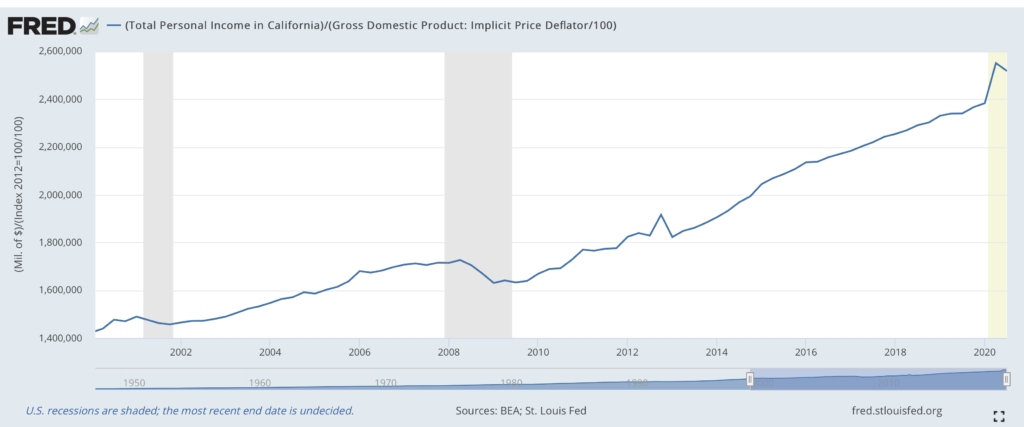

To see why, consider the state and national trends in personal income. Personal income measures the total amount of money people receive from all sources, including government benefits. As the following two charts from the St. Louis Federal Reserve’s economic database (FRED) illustrate, inflation adjusted personal income for the U.S. (the first chart) and California (the second chart) is higher as of the end of 2020 compared to the beginning of 2020. Not only is income higher today than ever, but the previous stimulus of $1,200 ($2,400 for married couples) that was distributed in March 2020 created spikes in personal income, which is visible in both charts.

The continued rise in personal income, coupled with the reality that you cannot stimulate an economy that you are simultaneously shutting down, undermines the justification for either the California or U.S. government to implement an economic stimulus. Even more unjustifiable is using the misguided arguments for a stimulus as an excuse to make unaffordable and wasteful government expenditures. Unfortunately, Governor Newsom’s plan is rife with such wasteful expenditures.

The continued rise in personal income, coupled with the reality that you cannot stimulate an economy that you are simultaneously shutting down, undermines the justification for either the California or U.S. government to implement an economic stimulus. Even more unjustifiable is using the misguided arguments for a stimulus as an excuse to make unaffordable and wasteful government expenditures. Unfortunately, Governor Newsom’s plan is rife with such wasteful expenditures.

Consider Governor Newsom’s proposal to spend $777.5 million on the so-called “California Jobs Initiative”. More than half of these expenditures ($430 million) will increase funding to the California Competes Tax Credit program (CalCompetes). CalCompetes is a bribe to politically favored companies to remain in, or move to, California. The program overtaxes one group of Californians so state leaders can disburse the largesse to politically favored ones. It is only necessary because California’s excessive tax and regulatory burdens have made the state economically uncompetitive.[i] Not only is the politically driven transfer inherently wasteful, but there is also no reason to expect that tax credits provided by CalCompetes will be extended in a timely manner or that the expenditures will help the businesses and families who have been economically impacted by the shutdowns.

Another troubling proposal spends an additional $1.5 billion on zero-emission vehicles and zero-emission vehicle infrastructure. As I have documented elsewhere, California’s approach to reducing greenhouse gas (GHG) emissions is both costly and ineffective. The costs include lower economic growth and a disproportionate burden on California’s lower-income families. Despite these costs, the decline in California’s GHG emissions is less than the national average (a 9 percent decline in California compared to a 15 percent nationally). Using the economic hardship caused by the Covid-19 pandemic as an excuse to expand these regressive policies is anti-growth and will harm lower-income families the most.

Giving additional money to people based on income is a similarly stimulus-inspired mistake. The primary policy goal should be supporting businesses and families who are enduring virus-induced economic hardships. Sending out checks based on income, even if the person’s income has not been adversely impacted, is wasteful and ineffective.

The Covid-19 pandemic has imposed significant economic costs, and the best way to mitigate them is to provide tailored support to the impacted businesses and families. Unaffordable expansions of wasteful programs, such as those proposed by Governor Newsom, are ineffective responses that, if implemented, will leave a legacy of debt and slower growth.

[i] It is important to note that improving the competitiveness of California is an important goal that should be pursued. The best way for Governor Newsom to attract and retain businesses is to make the state’s environment more competitive by reducing the tax and regulatory burden on businesses and families.