Railing about sky high drug prices makes good political theater and helps drum up support for the latest attempt to impose drug price controls (H.R. 3 or the Lower Drug Costs Now Act). This accusation also perpetuates misinformation.

If implemented, H.R. 3 would endanger patient access to current efficacious medicines and threaten the innovation that is leading to better treatments for cancer and cures for awful diseases like spinal muscular atrophy. It would also make it more difficult to resolve the actual problems afflicting drug markets.

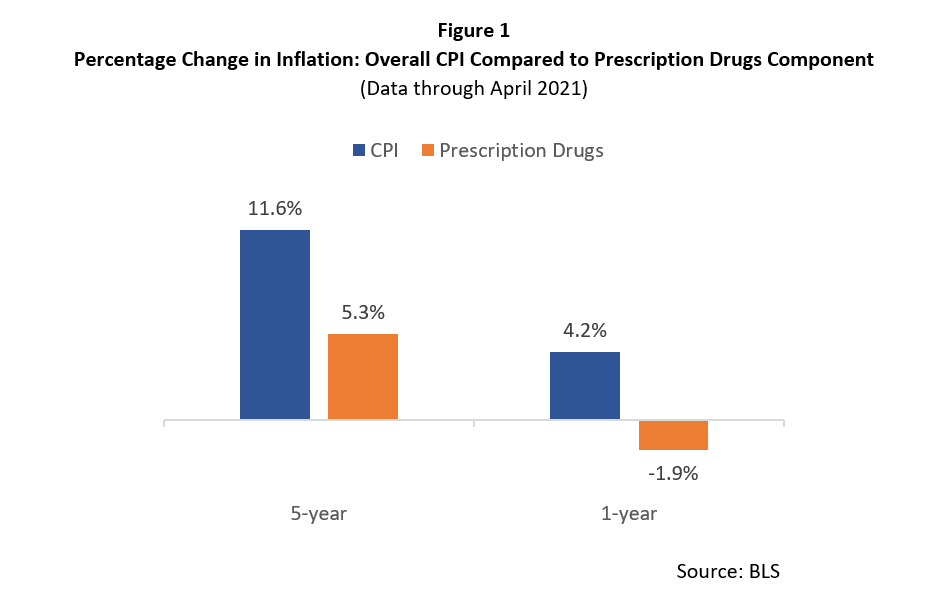

H.R. 3’s proponents argue that drug prices are growing faster than inflation, which is why they are proposing price caps, so let’s start by looking at the inflation data.

Figure 1 compares the percentage change in the consumer price index (CPI) measure of inflation to the growth in the prescription drug price component of the CPI over the past year and the past five-years. Clearly, according to the BLS, the growth in prescription drug prices has been less than the growth in overall inflation. Put differently, the average prescription drug is becoming more affordable relative to the prices of all other goods and services in the economy.

Prescription drug prices are growing slower than overall inflation because affordable lower-cost generic medicines dominate the U.S. market. They represent 90 percent of all drugs sold over the retail counter and 92 percent of these medicines are filled for a cost of $20 or less. As a result, most people are purchasing affordable medicines.

Drug prices that are growing slower than overall inflation also undermine the argument that drug prices, on average, are rising out of control. However, the reality that average drug prices are not out of control does not mean that affordability problems do not exist. They do.

As PRI’s Center for Medical Economics and Innovation has demonstrated, the affordability problem is a targeted problem driven by several policy inefficiencies. For instance, complexities and inefficiencies inherent in the biopharmaceutical market create perverse incentives that promote the use of more expensive medicines rather than less expensive alternatives.

The opaque pricing environment is inappropriately shifting costs from insurers to patients through their required co-insurance payments. And, competitive biases against biosimilars are discouraging the use of these lower-cost competitive products despite their ability to substantially reduce the costs of biologics (which are some of the most expensive innovative medicines available to patients today).

Instead of imposing broad-based price controls, Congress should address the affordability problem by promoting greater price transparency, reforming the perverse incentives of the current drug rebate system, and encouraging greater market competition (particularly from biosimilars) to drive down the prices of the most expensive drugs. Reforms that directly target the policy inefficiencies that are fueling the current drug affordability problems is the most effective way for Congress to address the current drug affordability problems.

By making broad claims that drug prices are rising faster than inflation, the architects of H.R. 3 demonstrate an inexcusable lack of knowledge regarding the actual market realities. As a result, should H.R. 3 be implemented, the draconian price controls at the heart of H.R. 3 will worsen patient access to innovative drugs, reduce future innovation, and harm patient health.

Dr. Wayne Winegarden is a senior fellow in business and economics at the Pacific Research Institute, and the director of PRI’s Center for Medical Economics and Innovation.