Too Much Government Spending and Volatile Tax Revenues Drive State’s Budget Problem

Wayne Winegarden

March 2024

This analysis is the first publication of Spending Watch, a new initiative from the Pacific Research Institute. Spending Watch is a resource that evaluates the revenue, spending, and economic impacts of major budget and policy proposals. The purpose of a budget is to establish an affordable spending level and then prioritize spending choices to ensure that total spending remains affordable. In addition to responding to budget and policy proposals, Spending Watch analyses will also proactively identify opportunities for spending control and efficiency improvements.

Governor Newsom was half correct in his January budget address when he claimed that “the state’s big three revenues [personal income taxes, sales taxes, and corporate income taxes] are projected to return to levels consistent with a normal revenue growth trajectory.”1 The current revenue decline is normal, but unfortunately, so were the years of surging revenues that preceded it. In fact, today’s budget difficulties are best understood as the latest manifestation of California’s volatile budget cycle.

The root cause of this destructive budget cycle is too much government spending that is enabled by a tax system that showers politicians with unsustainable revenues during good economic times. Since politicians eagerly spend all the money when the state’s coffers are overflowing, expenditures surge to unaffordable levels during economic booms. When the economy slows, as it always does, the unsustainability of the spending spree is revealed by the crash in state tax revenues and the onset of the inevitable budget crisis.

Resolving the crisis requires fiscal discipline, but historically politicians often use difficult times to push for counterproductive tax increases that only worsen the next cycle. Eventually, total state spending becomes affordable again due to years of expenditure controls coupled with the eventual economic recovery that reignites income growth. Historically, the affordable level of government has been between 7.5% and 8% of residents’ income.

Governor Newsom’s 2024-25 budget exemplifies this destructive pattern.

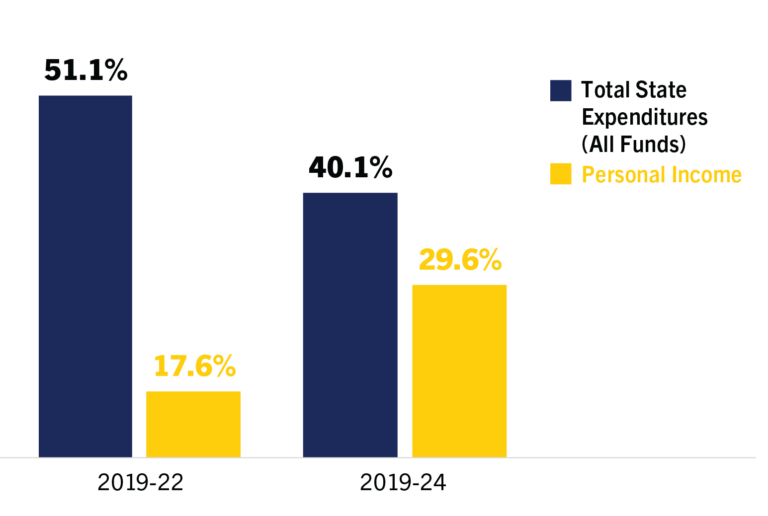

Compared to 2019 when Newsom took office, he and the Legislature went on a spending binge that lasted until 2022. During this euphoric period, total state spending from all funds grew more than 51 percent compared to just under 18 percent growth in personal income, see the Figure on this page. California’s government quickly became unaffordable as a result because total spending increased from around 8 percent of personal income to well over 10 percent. Today’s budget crisis is simply the necessary correction to this unaffordable spending.

This crisis is forcing the Governor and Legislature to make difficult decisions to wring out the unaffordable spending. To wit: if the Governor’s spending levels were implemented and personal income continued growing at around 5 percent annually, then the total recommended spending in the Governor’s 2024-25 budget would fall to a bit under 9 percent of projected personal income. Such spending levels are an improvement but still historically unaffordable. This indicates that additional budget difficulties lay ahead – particularly if the expected economic “soft landing” fails to materialize.

Sustainably addressing California’s budget problems requires political leaders to replace the state’s current destructive spending cycle with an affordability approach toward budgeting. Budgeting from an affordability perspective begins by asking a simple question: What level of spending can California’s taxpayers afford? There are many ways to answer this question.

Given the sheer amount of waste and ineffective state spending, Spending Watch defines an affordable state government as the level of spending that maximizes state economic growth. Historically, this level of spending is around 8 percent of personal income. Based on this definition of affordability, total state spending in 2024 should be about $25 billion smaller than the Governor’s proposed budget of $291 billion in total state expenditures.

Immediately establishing an affordable level of government spending is likely unreachable, which is why a gradual approach is called for. Consequently, the goal of the next several budget cycles should be to align spending with the 8 percent affordability threshold.

Between 2019 and 2022, state expenditures (+51.1%) grew much faster than income (+17.6%), even Newsom’s recommended budget discipline through 2024 does not restore the balance

Source: Author calculations based on total state expenditure (All Funds) data from ebudget.ca.gov and personal income data from the Bureau of Economic Analysis.

The benefits from establishing an affordable level of government include significantly reducing the state’s budget volatility and incentivizing stronger economic growth. By adhering to the spending mantra of doing better with less, the state has an opportunity to provide improved public services and incentivize faster private income growth.

Combining spending prioritization with regulatory reforms will further accelerate personal income growth, easing the transition to an affordable state government. Once established, the benefits of these reforms should be enhanced with tax reform that incentivizes economic growth and generates a more stable revenue source in good times and bad.

KEY TAKEAWAYS

The state’s budget problems are caused by too much spending and a volatile tax system.

Unaffordable spending fuels outmigration, unemployment, reduced growth.

Solving the crisis requires lawmakers to ask: what level of spending can taxpayers afford?