The Administration’s call to impose billions of dollars of tariffs on Americans who consume goods and services made in China is economic folly. Nevertheless, the Administration incorrectly touts that these tariffs will benefit the economy. Such claims are simply wrong.

The justifications for imposing tariffs are based on many myths, too many to be debunked in one blog post. So, let’s start by debunking the myth that tariffs on China would be beneficial because the U.S. has a large trade deficit with China. The supporters of these tariffs claim that large trade deficits are bad, must be avoided, and show that the U.S. is not benefiting from global trade. Nothing could be further from the truth.

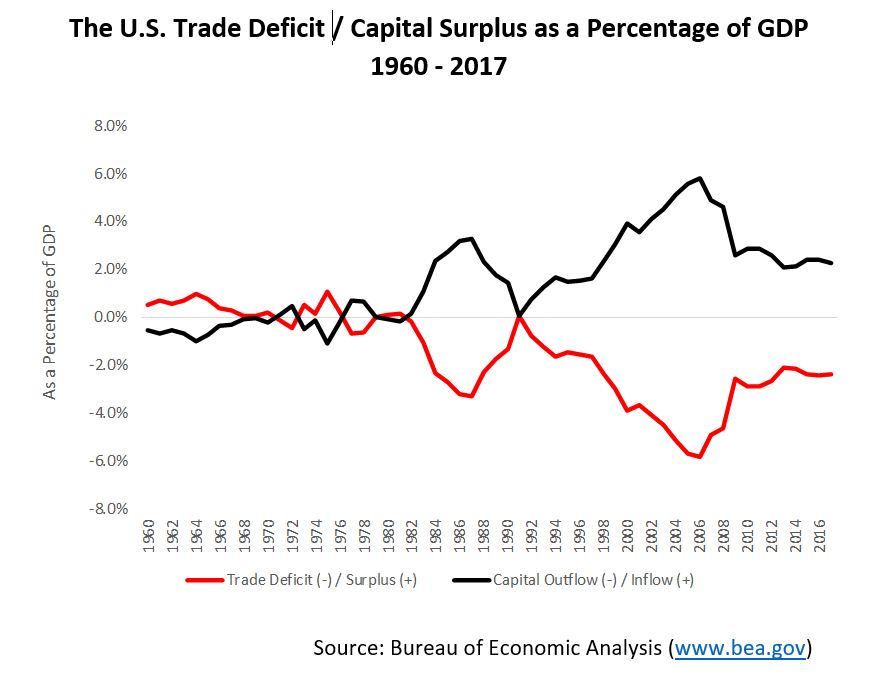

Yes, a large trade deficit sounds terrible. But, a large capital surplus sounds good doesn’t it? In reality, these are two different ways to measure the exact same economic phenomenon. As the figure below shows, trade deficits and capital surpluses are accounting identities that, by definition, must be the exact inverse of one another.

When the U.S. is running a trade deficit / capital surplus it simply means that we buy more goods and services from other countries than they purchase from us; but, they “purchase” more investments from the U.S. than we “purchase” from them.

Perhaps most importantly, we as Americans benefit from both situations. People purchase more goods and services from abroad because they prefer the quality and cost combinations offered by these products. When people from other countries invest in the U.S., these investments increase our capital stock funding the construction of new buildings, new entrepreneurial ventures, and the large federal budget deficit. In short, these investments improve our overall standard of living. It is a win-win outcome.

Imposing tariffs on foreign goods, raises the price of these goods when they are sold in the U.S., and are anti-growth tax increases paid by U.S. consumers.

Take the proposed steel tariffs. Since steel using industries must now pay more for their steel, consumers of products such as cars, appliances, and utensils must now pay higher prices. They are made worse off. Just as bad, there are now fewer dollars available for foreigners to invest in the U.S. economy. With less investment, there will be fewer productive resources available to raise wages and power future growth.

Some in the Administration recognize these economic harms but claim that the tariffs are valuable tool for threatening our trading partners to address other issues, such as the very real problem of China stealing U.S. intellectual property, which has been occurring for far too long.

But, tariffs are not an effective negotiation tool. History teaches that when one country imposes tariffs other countries respond by implementing even more destructive tariffs. The costs are borne by the average person across the globe in terms of less opportunity and greater poverty.

Just as Willis Hawley and Reed Smoot were wrong about tariffs in 1930, the Administration is wrong about tariffs today. Imposing tariffs will counteract the positive economic momentum that tax reform and deregulation are providing the economy. And, just as the Smoot-Hawley tariffs made a bad depression Great, imposing tariffs today will perpetuate the slow growth that has plagued the economy for much of the 21st Century.

Wayne Winegarden is senior fellow in business and economics at the Pacific Research Institute.