“The way to crush the bourgeoisie,” said Lenin, “is to grind them between the millstones of taxation and inflation.” So, it would have put a crocodile smile on Lenin’s face to learn that May’s inflation data showed that Americans’ wallets were worn down even further. The year-over-year inflation rate came in at 8.6 percent – a 40-year high. And the monthly data showed that prices rose 1 percent over April, shattering all estimates. If this keeps up, consumers could see an annualized inflation rate of more than 12 percent.

In another bit of bad news, the University of Michigan consumer sentiment index fell sharply from 58.4 percent to a record low of 50.0 percent in June. Think about it. Americans are gloomier now than during the pandemic lockdowns of 2020, more discouraged than the 2008 global financial crisis which caused the Great Recession, more pessimistic than the 2001 dot.com bust; and more melancholy than the 1990-91 recession, when, as a newly minted MBA, finding a job was nearly impossible.

Responding to this one-two punch of bad news, the Federal Reserve raised interest rates by 75 basis points, a rate hike not seen in nearly three decades. But does the Fed have the fortitude to raise interest rates even further to where it can actually break inflation? It would mean that millions of Americans would lose their jobs, watch years of retirement savings fritter away, and the equity on their homes disappear. Moreover, raising rates would make servicing the $1 trillion Federal deficit even more expensive, forcing the government to raise taxes — a prospect that would bring more joy to Lenin.

“[Raising interest rates is like] clearing off your snowed-in driveway with an ice cream scooper,” said David Einhorn, founder of Greenlight Capital at an investment conference. Einhorn said that if the government had to choose between causing a government financial crisis and high inflation, the Fed is going to choose government. “The Fed is bluffing,” said Einhorn, “It simply can’t do much more because it must undoubtedly ensure that the Treasury can fund itself. When the Fed has to choose between fighting the inflation and supporting the Treasury, I think it has to pick the Treasury.” So, if Einhorn is right, more inflation is on the way.

In Los Angeles, the U.S. Bureau of Labor Statistics reported that food at home rose 10.9 percent in May (so much for avoiding restaurants), household energy was up 17.7 percent, and motor fuel up 44 percent. Gas is now an eye-popping $7 a gallon in many So Cal cities. The rest of the state isn’t faring much better. In San Francisco, the fine dining capital of the West, food away from home rose 6 percent, while transportation rose 19 percent.

Notwithstanding, politicians in Sacramento are still debating about what to do. Biden is calling for a three-month suspension of the Federal gas tax. A savings of 18.4 cents a gallon may be a gimmick, but it is something. And if blue California takes Washington’s lead, combined with federal gas taxes, a California gas tax holiday would mean a savings of 72 cents a gallon. Now we’re talking – that’s impressive bragging rights for the mid-term elections.

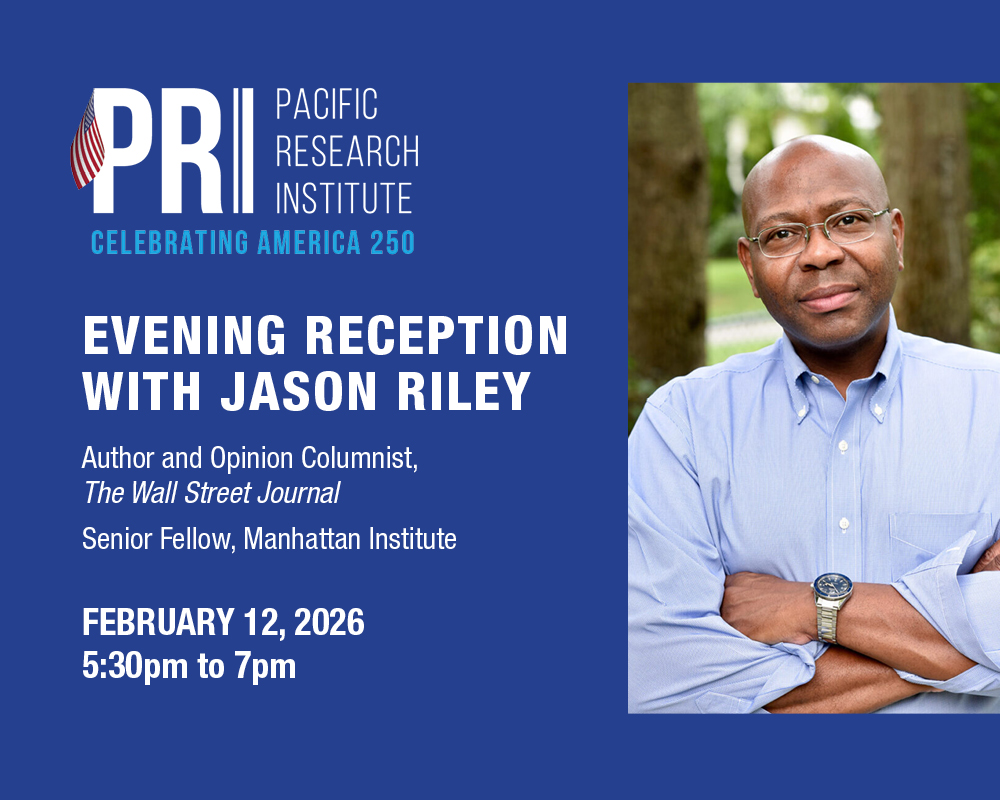

Rowena Itchon senior vice president of the Pacific Research Institute.