Many California cities will not fare so well on the fiscal roulette wheel. They’re not in Silicon Valley. Their local companies do not include Apple, NVIDIA, Meta/Facebook or Alphabet/Google (whose co-founders are leaving the state, while corporate HQ will remain). Those and many other companies’ rising stock valuations shed tax revenues like my dog Ollie’s fur in the summer.

In December, a Reason Foundation study found, “California’s state and local pension plans have over $265 billion in debt.” The so-called “California rule,” more a legal doctrine upheld by the courts than a law, largely forbids reductions in promised benefits, with taxpayers on the hook. And the per-resident liability is more than $6,000. For those who stay in the state.

All cities are different. The key to look for is each city’s “unrestricted net position.” If positive, good. If negative and a high number, the city could face financial problems, and could face some risk of bankruptcy, during an economic downturn. Or residents could face pressure to approve tax increases.

The UNP is found in a city’s annual Annual Comprehensive Financial Report. And a negative per-capita UNP shows how much each resident owes. Unlike a budget, which is a future estimate, an ACFR is an actuarial accounting of the previous fiscal year. That’s what I’ll be using in the next section.

Here are four cities from non-Silicon Valley areas facing fiscal crises right now.

Los Angeles, population 3.9 million. The Daily Journal reported on November 24, “Mounting wildfire liabilities, sexual-assault settlements, revenue losses and soaring legal payouts have intensified concerns that Los Angeles, L.A. County or Santa Monica could face insolvency and contemplate the once-unthinkable step of Chapter 9 bankruptcy.” All just in time for this summer’s FIFA World Cup 26 and the 2028 Olympics.

In his January 29, 2025 introductory message for L.A.’s ACFR for the fiscal year ending June 20, 2024, Controller Kenneth Mejia wrote, “As we warned at this time last year, the City is continuing to spend well beyond our actual revenues and adopted budget. … Given the devastating damage and disruptions from the firestorm disaster, the fiscal stress could not come at a worse time. We’ve gone from record levels of General Fund reserves 18 months ago to the brink of needing to officially declare a ‘fiscal emergency.’” His ACFR for fiscal 2025 should come later this month and will reflect the actuarial damage from the wildfires.

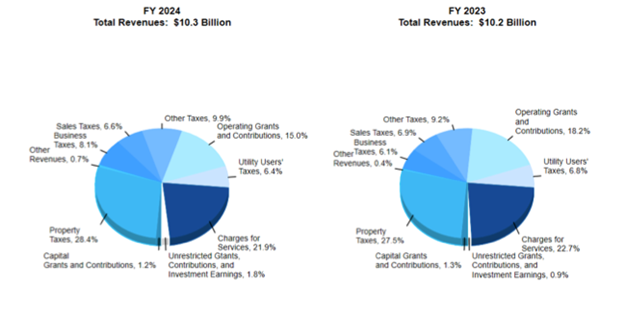

The 2024 ACFR itself tallied a negative UNP of $5.8 billion, or $1,487 owed per capita. It noted $10.3 billion of revenues, but $11.3 billion of expenses. And it provided this chart showing revenues essentially were stagnant, rising just $100 million from the $10.2 billion of 2023. That clearly shows the city’s high taxes and regulations are repelling investment in new businesses, ironically suffocating growth in the tax base.

Santa Monica, population 91,000. The city’s ACFR for the fiscal year ending June 20, 2024 showed a negative UNP of $52.7 million, or $597 owed per capita. Although less than for some other cities, in his introduction Director of Finance/City Treasurer Oscar Santiago warned, “While the long-term economic outlook is positive, resources remain constrained in the short-term. The city continues to experience significant cost increases coming from the highest levels of inflation in 40 years and other market disruptions occurring as a result of global conflicts.”

Orange, population 138,000. Located in prosperous Orange County, the city of Orange ought to enjoy an overflowing budget. But the Voice of OC warned last July 30, “Orange City Council members received a stark warning from their accounting consultants last week: they’ll be facing bankruptcy in three years if they don’t increase sales tax, cut 12% of their general fund and bring new businesses into the city.”

Shawn Stewart, a principal from the consulting firm Grant Thornton, told the council, “We have a Nordstrom’s appetite and we have to operate on a Walmart budget.” (It’s an apt comparison as Nordstrom’s own financial problems led it to go private last May. And Nordstrom’s store at Main Place Santa Ana, right south of Orange, closed in 2017.)

Orange’s ACFR for the fiscal year ending June 30, 2024 showed a negative UNP of $195 million, or $1,413 per capita. A 0.5% sales-tax increase on the Nov. 2024 ballot was defeated, 50.43% to 49.57%.

Vacaville, population 104,000. The San Francisco Chronicle reported January 12, “To balance its last fiscal-year budget, Vacaville needed to dip into reserves and freeze hiring. Its five-year financial forecast currently projects an annual deficit of roughly $9 million.” Its ACFR for the fiscal year ending July 30, 2024 showed a negative UNP of $114.6 million, or $1,102 owed per capita.

Having written about California politics now for 38 years, the problem in large part remains the fiscal greed of the public-employee unions. They want everything for themselves, regardless of the cost. And as with new Mayor Zohran Mamdani in New York City, they look on economics as a zero-sum game.

The union officials and their kept politicians don’t see how fiscal prudence and reasonable taxes and regulations promote greater prosperity, lifting all boats instead of sinking them.

John Seiler is on the Editorial Board of the Southern California News Group and blogs at johnseiler.substack.com