In its Multiyear Budget Outlook, the Legislative Analyst’s Office (LAO) summed up the dire state of California’s fiscal state. According to the LAO,

Both our office and the Department of Finance (DOF) project operating deficits ranging from $10 billion to $20 billion over the multiyear period. These shortfalls represent future budget problems that would require additional budget-balancing decisions.

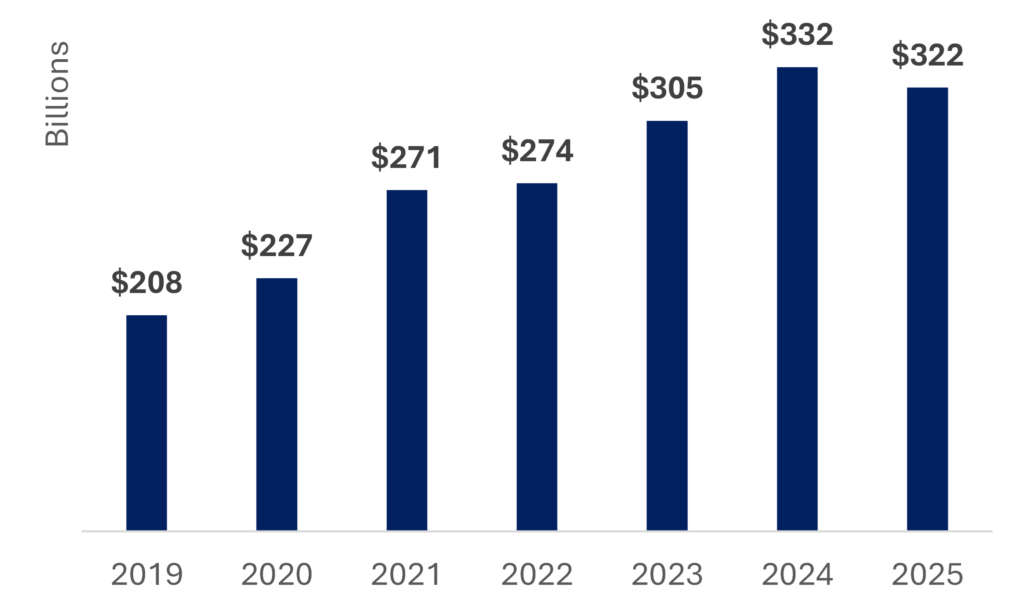

The cause of the current financial crisis is clear. Total state spending under Governor Newsom has grown 7.5 percent annually and is now 55 percent higher in the proposed Fiscal Year 2025-26 budget compared to the FY 2019-20 budget. Californians’ incomes have grown 39 percent over this time meaning that the growth in state spending has outpaced the growth in residents’ ability to pay for that spending.

Total State Funded Expenditures Up 55 Percent Under Governor Newsom

Unfortunately, as the LAO also notes, the “shortfalls will become increasingly difficult to resolve over time, as the state has already relied on the least disruptive solutions—such as reducing one-time and temporary spending, drawing down reserves, and increasing borrowing….”

California has reached a fiscal crossroads as a result. The temptation for Sacramento politicians will be to tax their way out of the deficit. Such a strategy will be a mistake.

Total state and local revenues in California equal 18 percent of residents’ personal income, which significantly exceeds the average state’s tax revenue burden of 15 percent. California also suffers from the highest state marginal personal income tax rate, the 6th highest corporate income tax rate in the country, and the 8th highest state and local sales tax rate. Of all states that don’t rely on a severance tax (volatile taxes on oil and mining levied in states like Alaska), California has the most volatile revenue system.

The consequences of these anti-growth policies are beginning to show. Starting in July 2022, total employment growth in California has stagnated even while total employment growth in the U.S. has continued expanding. California’s share of the national economy is also in decline. Since its peak at 14.4 percent of total national income in the third quarter of 2020, California’s share has declined to 13.7 percent.

What makes this decline more notable is that it has occurred during an economic expansion. Typically, California’s economy grows faster than the national average when the economy is expanding and then crashes harder when the economy is in recession. The relative underperformance during the current economic expansion is an ominous sign for the state’s future economic vibrancy.

Raising taxes to balance the budget will only worsen these negative economic trends. It also misdiagnoses the problem. The state is facing years of budget deficits because, under Gov. Newsom, the state has simply spent too much. Raising taxes does not fix a spending problem – it only encourages more of it.

Unfortunately for Californians, legislators are already uncomfortable with the Governor’s modest and inadequate spending discipline. It seems unlikely that they will demonstrate the willingness to embrace the necessary fiscal discipline to sustainably address the current budget crisis. Instead, policymakers in Sacramento will likely turn to continued budget gimmicks and wishful thinking to find short-term solutions to our long-term spending problem.

Such strategies rarely result in good outcomes.

Dr. Wayne Winegarden is a senior fellow in business and economics at the Pacific Research Institute.