Earlier this month, an optimistic Newsom claimed while presenting his latest proposed budget that it ‘reflect(ed) both confidence and caution,’ but if the state’s past performances are anything to go by, then Californians should be wary.

The National Association of State Budget Officers’ (NASBO) latest Fiscal Survey of States shows what Pacific Research Institute has covered extensively, that ill-disciplined spending has contributed to large budget deficits .

California’s fiscal ambitions are driven by what Newsom describes as “higher-than-projected revenues,” though this highly-debatable belief is undercut by the expected growth in expenditures.

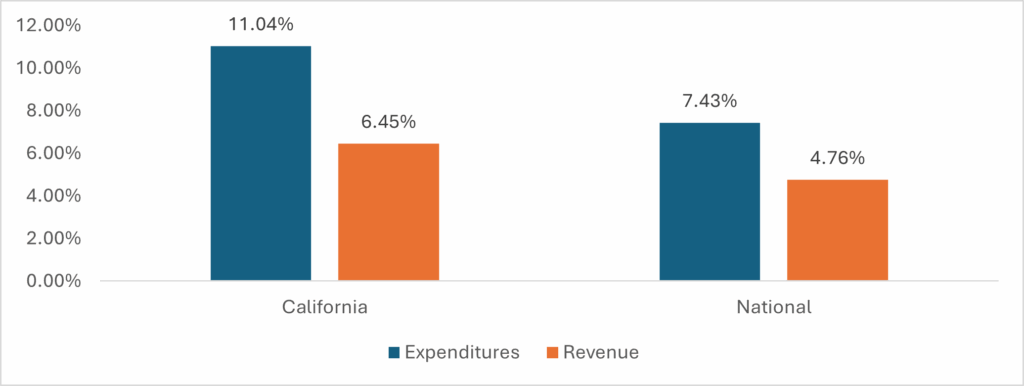

Table 1 shows that based on California’s enacted General Fund for fiscal year 2026, California’s expenditures are expected to grow one and a half times as fast as the rest of the states, and nearly twice as fast as California’s revenue growth. This is unsustainable and while the same holds true nationally, the problem is worse in the Golden State.

Newsom was fortunate in that surprisingly-strong revenue collections provided a justification to project a deficit of nearly $3 billion, compared to the $18BN shortfall the nonpartisan Legislative Analyst’s Office predicts.

The LAO acknowledged these “strong trends in income tax collections,” but cautioned that “recent income tax gains are tied to an unsustainable stock market” driven by AI optimism, a point made by PRI’s Tim Anaya. Indeed, personal income tax receipts increased by 9.6% in two years but are expected to decline marginally this year.

A decline in personal income tax revenue would sting even worse as lower corporate and sales tax receipts drop as well, caused by uncertainty and pessimism over the American economy more broadly. Even if, however, California’s reliance on an AI-fueled stock market is sustainable, the LAO points out that revenue gains will be offset almost entirely by constitutional spending requirements.

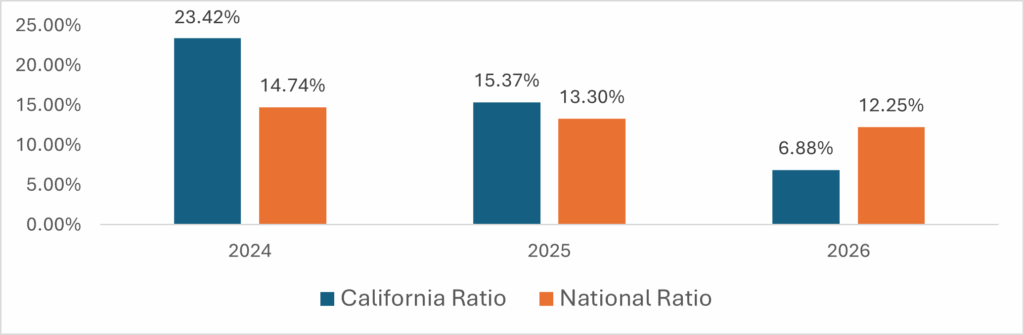

Equally important is the impact that California’s spending has had on the State’s Rainy Day Fund balance. NASBO acknowledges that rainy-day funds as a percentage of total expenditures across the nation have been declining for two years and are expected to do so again in 2026.

But while the national ratio of rainy-day savings to expenditures has marginally dropped two percentage points since 2024, Table 2 demonstrates that in California that ratio is expected to drop by 16 percentage points during the same time period.

As most people with a household budget know: If you’re using savings to pay your bills you’re going broke.

Put simply, California’s budget woes follow national trends, but the problem is worse here. Last year, the state increased spending by 13.6%, over three times as much as the median state. California is projected to cut spending by 2.2% this year, but that follows spending growth that far exceeded any other state.

NASBO reports that while most states (in absolute terms) avoided dropping rainy day reserve levels over the past two years, California is trending in the opposite direction. In fact, the state’s Rainy Day Fund Balance is expected to drop by a whopping 67% contraction since 2024.

If the administration wants to reverse an alarming streak of four consecutive years of projected budget deficits and put California back on track, it must learn from its mistakes – something Newsom’s latest proposal does not do.

Nikhil Agarwal is a Pacific Research Institute research associate.