Sacramento has been trying for some time now to add a 95-cents-a-month tax on drinking water to pay for “secure access to safe drinking water for all Californians, while also ensuring the long-term sustainability of drinking water service and infrastructure.”

Those dreams of more taxes were delayed last week, though, when Gov. Jerry Brown and Sacramento’s political bosses agreed to drop the “Safe and Affordable Drinking Water Act” during budget negotiations.

Supporters of the drinking water tax say it would have been only 95 cents a month, enough to raise $140 million in annual revenue but not enough make a dent in any family’s household budget. But that rationalization obscures the greater point that Californians are taxed, taxed and taxed again. It’s become the California Way.

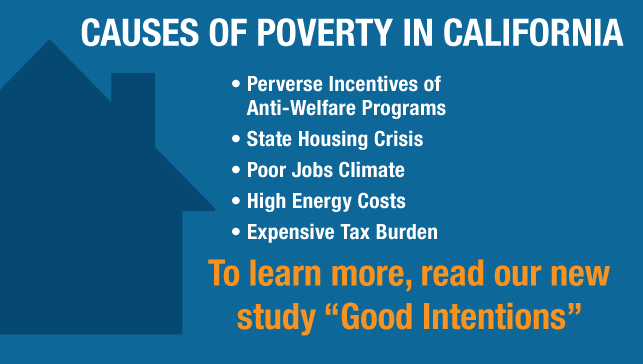

Policymakers at all levels seem to never tire of trying to find new things to tax. The California Taxpayers Association counted 98 proposals that would raise local taxes on the June 5 primary ballot. The organization has also found that in 2017, lawmakers introduced more than 90 bills that would increase taxes and fees by $370 billion a year.

Is there no end to policymakers’ insatiable appetite for other people’s money?

At 95 cents a month, or $11.40 a year — and as much as $2 a month for some large homes — the drinking water tax might seem like a bargain to ensure that all Californians have water that is safe to drink and cook with. But why levy a new tax? If the goal of the legislation is so critically important, why not trim spending in programs of lesser importance to pay for the project? The 2018-19 budget deal between Brown and legislative Democrats indicates the state will spend roughly $200 billion in the next fiscal year. Finding $140 million of fat in a budget of that size wouldn’t be hard, especially when the state has an $8-$10 billion revenue windfall this year.

Another alternative to the tax, according to Scripps Media, is “applying cap-and-trade funds for localized groundwater contamination cleanup and remediation programs.” Evidently this would be consistent with cap-and-trade’s goals because it “would reduce the need to transport water long distances, thereby reducing greenhouse gas emissions.”

Of course, it would be politically difficult to make cuts elsewhere, or to tap into the cap-and-trade funds. But then as it turns out, the Safe and Affordable Drinking Water Act ran into its own political thicket and had to be dropped.

Brown, though, has not given up the quest. The media are reporting that he simply believes that more money is needed. Apparently, he failed to notice that on June 5 voters passed Proposition 68, a $4.1 billion water bond that will provide $250 million for clean water projects, and that voters might also approve another $500 million in the fall for clean water through an $8.9 billion ballot measure water bond.

This episode in California politics makes one wonder just how much tax revenue is ever enough in this state. The craving never seems to ebb. We are quickly moving toward the dangerous point at which policymakers’ demands for money exceeds the measure that taxpayers can provide. That’s the stage in which it becomes obvious that blue states are actually red.

Kerry Jackson is a fellow with the Center for California Reform at the Pacific Research Institute.